Filing bankruptcy may actually improve your credit score if you're already behind on payments. Most people see their scores recover to the 600s within one to two years and can reach the 700s within two to three years post-filing. Solo can help you respond to debt lawsuits, and Upsolve offers free Chapter 7 bankruptcy filing assistance.

To settle a debt collection lawsuit, file an Answer to prevent default judgment, use disclosure documents for leverage, negotiate knowing offers aren't admissible in court, and check if statute of limitations has expired. Solo can help you respond properly, and SoloSettle connects you directly with collectors to negotiate settlements.

Love, Beal, and Nixon may be more willing to settle debt outside court than you think. To succeed, you must not ignore communication from the firm. Respond to collection letters and calls with a Debt Validation Letter. If they verify the debt, review your finances and consider making a settlement offer.

Today I'm going to show you an interview that I recently had with a real former debt collector named Bill. Bill used to work for Avante USA, Ltd Financial, which are three debt collection agencies based out of Houston, Texas. In our interview, he spills secrets and tactics that he used while working as a debt collector to get people to pay up.

Una deuda en colección es una instancia en el proceso de cobro de deudas en la cual la gestión de la cobranza pasa del acreedor original a una agencia de cobros (Collection Agency), quien, asume entonces la responsabilidad de cobrar la deuda en nombre de la empresa original; o, a veces, la agencia compra la deuda y luego la cobra en su propio nombre.

Swift Funds Financial, also known as Swift Financial Services, is a debt collection agency that specializes in the collections of unpaid gym and fitness account balances and other fitness industry collection needs. So, if you have some sort of gym membership that goes without paying, you may be contacted by Swift Funds Financial.

Despite state and federal laws, there are still debt collectors in the industry with a reputation for using questionable methods to collect debts, many of which are downright violations of the law. Below is a guide on how to resolve debt with Puget Sound Collections. Even if they sue you, SoloSuit can help you get out of this situation by responding to the lawsuit and settling the debt before your court date. Keep reading to learn how to respond to Puget Sound Collections

If you're facing harassment from such a debt collector, remember that you're not powerless. Maryland and federal laws offer strong protections to shield you while you navigate the challenges of settling a delinquent account. These legal safeguards are there to ensure your peace of mind during this tough time. This article provides a comprehensive summary of debt collection laws in Maryland, including laws pertaining to the statute of limitations.

You’re having a relaxing day off when you suddenly get a call from an unfamiliar number. Out of curiosity, you answer the phone, only to find that it’s a call from a debt collector. According to the caller, you owe a substantial debt, but this is the first you’ve heard of it. You’re tight on cash as it is — how are you going to pay for this, too?

If you’ve just gotten a call from Alltran Financial, you probably have a lot of questions: Do I really owe money? Is this a scam? What should you do next? Having debt in collections is nerve-racking, so you’re probably in a hurry to fix the situation. But don’t rush into anything just yet — you might not owe what Alltran says you do. Here’s our guide.

Are you being chased by collectors from First Financial Asset Management? If so, your best option might be to negotiate a lower settlement amount. But before you do anything, you’ll need to take steps to assert your rights and verify that the debt is yours. Here’s how to resolve your debt quickly and painlessly.

It can be tough to distinguish between legitimate phone calls and scammers. But Diversified Adjustment is a legitimate debt collection company and one you shouldn’t ignore. If you’ve been contacted by Diversified Adjustment Service, it’s because they believe you have an unresolved debt with another party. Here’s how to verify that the debt is yours and resolve your debt quickly.

It’s like a twisted game show: Is this debt collection phone call a scam, or am I being contacted by a legitimate company? Unfortunately, it’s not a game. If you’ve been contacted by Source Receivables Management, you’ll need to act fast. Here’s what you need to know about this company and how to resolve your debt.

Debt collection laws in the Hawkeye State are intended to help protect consumers from inappropriate and harassing debt collection efforts. There are a number of state and federal laws that address how debt collectors can interact with consumers, namely The Iowa Fair Debt Collection Practices Act and the federal Fair Debt Collection Practices Act (FDCPA). Let’s take a closer look at these Iowa debt collection laws and how they can protect you from unscrupulous debt collectors.

Have you been ducking phone calls from Faber and Brand? That’s not the best strategy. Faber and Brand is a law firm that handles debt collection, among other things. If you ignore them, you could soon face a lawsuit — if you haven’t been sued already. It’s time to stop running and face your debt head-on. Here’s how to resolve your debt quickly and permanently.

Learn how to resolve debt with them by knowing your consumer rights and using various documents to stop their calls or win your debt collection lawsuit. Dealing with health issues is stressful enough, and medical debt only exacerbates the issue. The constant reminders from Marcam Associates debt collectors can be enough to drive you crazy. You may be asking yourself if it is a legitimate company.

We’ve all heard stories about debt collector calls that end up being scams. And unfortunately, it can be hard to tell the difference between a scam collection call and the real thing. If you’ve been getting calls from Dynamic Collectors Inc., you’re talking to a legitimate company. But are the debts they’re asking you to pay legitimate? Here’s what to do about a debt you allegedly owe to Dynamic Collectors.

If you’ve ever gotten a call from a debt collector, you know exactly how stressful it can be! And if BCA Financial Services has recently started bothering you about a debt, you probably want to get the issue resolved as soon as you can. You might not know that there are more ways to resolve a debt than paying it in full. Here’s how to deal with the debt that BCA Financial Services claims that you owe.

Suffering through numerous phone calls that seem to occur at all times of the day and night, receiving threatening letters in the mail, and other forms of intimidation and harassment by an unethical debt collector is generally considered to be awful by most people, including residents of North Carolina. If you find yourself being pursued by such a debt collection agent or agency, there are legal protections under both North Carolina law and federal law designed to protect you while engaging with a debt collector about a delinquent account.

If you had healthcare costs not covered by insurance, you could find yourself facing medical debt collectors like H&R Accounts Inc. You may have already been contacted by the company under the name Avadyne Health (which is the name used on the company website). But regardless of the name, your primary goal should be to respond quickly to the threat of a lawsuit and resolve your debt for a lower amount.

Suffering through numerous phone calls that seem to occur at all times of the day and night, receiving threatening letters in the mail, and other forms of intimidation and harassment by an unethical debt collector is generally considered to be awful by most people, including residents of the Granite State.

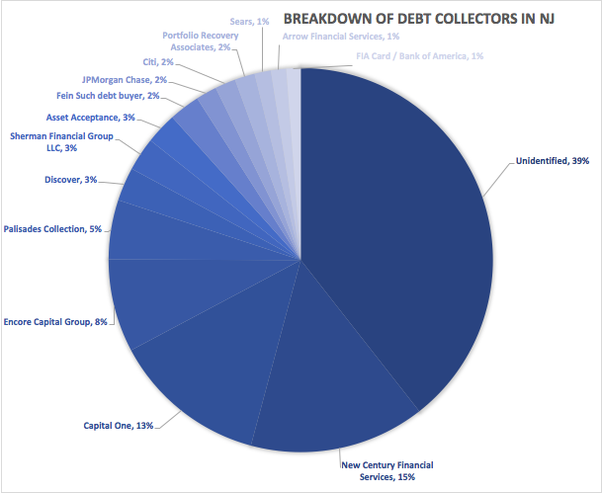

Dealing with an overly aggressive debt collector can be a difficult and stressful experience. Having financial problems is challenging enough on its own. Adding countless phone calls and threatening letters from a debt collector only serves to make the situation worse. If you are living in New Jersey and can’t seem to get debt collectors off your back, you can find solace in knowing you have legal rights and protections under both state and federal law.

You thought that old medical bill was paid for — until you were contacted by Synerprise Consulting. The company claims to be seeking to collect on your past medical debt. It may even threaten a lawsuit. Before you do anything, it’s important to verify that you owe this debt, then take steps to resolve your debt quickly.

Being subjected to countless phone calls, threatening letters, and other forms of intimidation by an unscrupulous debt collector is a nerve wracking and generally unpleasant experience for most people, including residents of Kansas. If you find yourself being pursued by a debt collection agent or agency, there are legal provisions under both state and federal law designed to protect you while engaging with a debt collector about a delinquent account.

Not many people know debt collection companies by name — until they’ve dealt with one directly, anyway. If you’ve been getting calls or letters from a company called Berlin-Wheeler, you have the distinct displeasure of dealing with one of the most established collection agencies. Do you need to find your peace again and get Berlin-Wheeler to leave you alone? Here’s the SoloSuit guide.

Student loans are challenging enough as it is. So when you received a notification from Trellis Company, it naturally made you long for the days when midterms were your biggest worry. Thankfully, you can act quickly to resolve your debt with Trellis Company while avoiding a legal battle or further damage to your credit.

You might consider ACE Cash Express if you need a short-term personal loan. Compared with payday loans, which are short-term loans, you can access money quickly but with longer repayment terms. Borrowers may apply for payday loans, installment loans, auto title loans, and cash advances. But before applying for an Ace Cash Express loan, find out more about the company. Find out what types of loans are available, including their interest rates.

Maybe you’ve just gotten a letter from MCA Management Company. Or maybe you’ve seen this company’s name pop up on your credit report. Either way, you know you want to resolve the situation right now. But wait! Don’t rush to pay the debt. You have the legal right to make a debt collector prove you owe money before you pay anything. In some cases, you might not have to pay anything at all. Here’s how to deal with MCA Management Company.

In today's fast-paced world, indulging in luxury experiences like wine tourism is a dream for many. However, balancing these desires with financial responsibilities, especially when dealing with debt, can be challenging. In my recent interview with Andy Abramson, avid and experienced world traveler and CEO of several companies, including wineTOURia, we explored ways to enjoy luxury adventures while also juggling debt or trying to be financially conscious.

You can use SoloSuit to respond to a debt lawsuit, file a Motion to Compel Arbitration, or settle the debt before going to court. Join our live webinars to ask your own questions about how to resolve a debt lawsuit. The following is a transcript for one of our webinars. In it, SoloSuit's founder George Simons responds to live questions from consumers.

Few things are as nerve-racking as being contacted by a debt collector. So, if you’ve been contacted by AAA Collections, you’ll want to work quickly to reach a settlement and resolve your debt once and for all. Here’s how to respond to AAA Collections.

If you’ve received a Court Summons for a debt collection lawsuit, watch this video to learn how to respond:

If you’re treading water financially, a debt collection phone call can feel like someone just tossed you an anchor. But there’s an easy way to resolve debt with ConServe Debt Collection without finding yourself in court. The following steps can help you avoid a lawsuit and settle your debt for a mere fraction of what you owe.

Some debt collectors operate with a very specific strategy. If you’ve been contacted by Valley Servicing, it may be asking to withhold a percentage of your wages to pay off a previous loan. The good news is that no one can withhold your wages without your permission or without a lawsuit. But if you have unresolved debt, your best option is to resolve it as quickly as possible. SoloSuit can help.

How long can you keep dodging debt collectors? If you’ve been contacted by Southern Management Systems (SMS), you’ll need a strategy that lets you resolve your debt once and for all. The following guide can help you respond to a debt collection lawsuit and settle your debt for a fraction of the original amount.

Synergetic Communication — also known as SynCom — is a full-service debt collection agency licensed to collect debt across the United States and Puerto Rico. If you’ve received a Synergetic Communication Inc. letter, email, or phone call, it’s because the company is attempting to collect on an unpaid debt. But if you take the following steps, you can resolve this debt and start moving on.

Personal loans can help consumers meet urgent financial needs, but as the number of lenders has skyrocketed, it is becoming harder for consumers to identify legitimate loan offers. ModoLoan connects consumers to real lenders and helps people get approved for loans, typically ranging from $250 to $3000, in minutes.

Even with insurance, healthcare costs can be debilitating. And if you get behind in your bills, you might start getting calls from RTR Financial Services. Don’t panic. There’s actually a simple way to resolve your debt without facing a lawsuit. Here’s how to respond to RTR Financial Services and move on with your life.

Debt collection phone calls from companies like Superlative RM can be annoying — but don’t ignore them. Even if you don’t believe the debt is legitimate, the collector sure does. If you don’t act, you could soon face a debt collection lawsuit. Here’s how to verify that your debt is yours, then resolve your debt quickly.

Does a person’s debt die when they do? The answer is often yes, but there are some gray areas. Unfortunately, debt collection agencies like AscensionPoint Recovery Services capitalize on that confusion to try to make people pay the debts of deceased loved ones. Here’s what to do if you’ve been contacted by AscensionPoint.

No matter how many times you deal with a debt collector, the process never gets easier. If you’ve recently been contacted by Global Trust Management, you might think you need to rush to pay back your debt. But when you know your rights, you can protect your financial well-being and avoid paying more money than you need to. Here’s what you need to know.

In recent years, BMG Money Loan has gained a reputation for providing payroll loans to help individuals pay for unexpected expenses. They emphasize that repayment is easy via deductions from salaries or pensions to make borrowing seem irresistible. If you’re considering a BMG loan, it’s best to investigate the long-term implications of first. In this article, we’ll cover everything you need to know about BMG Money Loan so you can make an informed decision.

Genesis Financial Solutions Card Services, Inc. —the servicers of Milestone ® Mastercard—market it as a second chance for 'non-prime' consumers to rebuild their credit. In other words, the credit card is supposed to offer a stepping stone for the following sets of people to build or rebuild their credit:

Traveling the world is a dream for many, but the fear of racking up debt can often dampen the adventurous spirit. And in many cases, the desire to explore the world can clash with the practical need to manage expenses and avoid debt. I recently had a chat with Andy Abramson, CEO of Comunicano and experienced world traveler, about how more accessibility to remote work has led to an increase in travel.

Debt collectors can be a real pain, especially if you don’t know who they are and they continue to call you and send you letters. You may fend off calls at your workplace (which is embarrassing) or get texts from the collection agency urging you to pay a bill. If Summit Account Resolution has an account with your name, you probably want them to lose your number. That’s entirely possible, but you must take a few steps to make it happen.

When you get a call from Benuck and Rainey Inc. (or any debt collector), it’s easy to jump into panic mode, thinking the only way to relieve the stress is to pay the debt immediately. But you might not realize that you have other options — and some of them might mean you have to pay nothing at all. Here’s our guide to resolving your debt with Benuck and Rainey.

You’d never heard of A.R.M. Solutions until you started getting calls about unpaid debt. Now, debt collectors are threatening you with a lawsuit if you don’t pay up. How do you know you’re not being scammed? This guide will help you verify the source of your debt, then devise a plan to settle your debt for a reduced amount.

Texas debt collection laws have been implemented to control the debt collection process and ensure creditors do not abuse consumers or use deceptive practices. When consumers ignore a creditor's attempt to collect their money, they resort to unlawful ways to increase their chances of making payments.

Perdue Brandon Fielder Collins & Mott is a debt collection law firm focusing on government receivables. If you’ve been contacted, it may be in regard to past debts on things like parking tickets, legal fees, or tax bills. Luckily, you can resolve the debt with the help of SoloSuit, whether it’s requesting debt validation, responding to a lawsuit, or negotiating a settlement.

Medical debt can be complex, as it involves you, your healthcare provider, and your insurance company. Left unpaid, it can also involve calls from organizations like CKMS. If you’ve received phone calls from Central Kentucky Management Services (CKMS), don’t ignore them. Instead, use the following guide to resolve your debt.

Chances are you’d never heard of Kinum, Inc. until you received a notification about your debt. But before long, Kinum representatives began calling you every day. Now, you may even be facing a debt collection lawsuit. Stay calm. Resolving your debt is easier than you might realize. Just use the following guide to respond to a lawsuit and negotiate a lower settlement amount.

Medical bills can be complex. If you’ve been contacted by the Rawlings Company, it’s likely that it is attempting to collect on a bill after partnering with your insurance or healthcare provider. Your first goal should be to determine whether the debt is legitimate. From there, you can take steps to resolve your debt.

Life happens. When it does, you may need to send a financial hardship letter to your creditors to request an adjustment to your monthly bill or payment schedule. Otherwise, late or missed payments could result in additional fees, penalties, and a reduction in your credit score. But how do you demonstrate financial hardship?

According to recent data, nearly 78% of America’s workforce is living paycheck to paycheck. That’s fine when your bills and expenses fit into your budget, but an unexpected setback like a car repair can prevent you from paying your monthly debts. When that happens, you can use a hardship letter to ask lenders for time to get caught up.

Dealing with debt collection agencies is never pleasant. Annoying phone calls and threatening letters can take their toll on even the most unflappable people, resulting in unnecessary stress and anxiety. Fortunately, you can take action to halt debt collection activities and get back to normalcy. If RSI Enterprises is the instigator of your debt collection letters, you’ll want to understand the company’s process and the rights available to you before you take action.

Debt consolidation has saved thousands of debtors from drowning in debt and filing for bankruptcy. In your search for a debt consolidation company, you may have encountered Americor. It is a recent addition to the many debt relief companies that help consumers pay off their debts without accruing excessive late fees and interest rates.

With countless banks available to serve you, it can be both exciting and confusing to know the best bank to open an account. In addition, you would also want a bank that can give you a loan at a reasonable interest rate and a credit card with fair terms. BMO bank has won favor with numerous consumers across North America because of its large ATM network, low fees, and diverse loan offers.

Has Merchants Credit Associations (MCA) harassed you by calling your cell phone, family, or friends? For one, the Merchants Credit Association is a third-party debt collector, which means they collect debts on behalf of other companies. Some consumers are scared of Merchants Credit Association and will lose sleep, suffer medical ailments from stress, and still have to prove the alleged debts.

Many consumers who require cash quickly turn to payday loans to meet immediate needs. These are short-term, high-interest loans due on the consumer's next payday. In recent years, online payday loans have been on the rise in America. One of these companies is Speedy Cash. However, payday loans are expensive, so you'll want to carefully consider the information below before deciding to go this route for quick cash.

When Mississippi residents are being subjected to harassment, intimidation and even threats by unethical and aggressive debt collectors, there are two federal laws providing statutory protections and rights to those residents: the Fair Debt Collection Practices Act and the Fair Credit Reporting Act. Mississippians who feel they’re being subjected to such improper and unfair behavior by a debt collector can take advantage of these federal laws to pursue relief.

An unpaid medical debt often ends up in the hands of a debt collector like PCB Collections Agency. These debt collectors will send you letters and call you, trying to get the money you owe. Sometimes, they’ll take you to court. In this article, we’ll explain who PCB Collections Agency is and what you can do to resolve your debt.

As a payday loan company with over 25 years of experience, Advance America has done well enough to stay in business. However, despite years of experience, Advance America charges very high-interest rates and fees, so it’s best to only borrow from them as a last resort. Plus, Advance America’s rates and fees are not transparent, and its collections practices are questionable as well.

Dealing with pushy and unfair debt collectors is really stressful. Getting endless calls, scary letters, and other wrong collection tactics can be really frustrating and upsetting. Talking to a debt collector might feel scary, but remember, you have specific legal rights. Pennsylvania debt collection laws, and other federal laws like the Fair Debt Collection Practices Act, are there to protect you.

South Dakota's Fair Debt Collection Practices Act and other consumer protection laws allow you to stop debt collector harassment. These laws also prevent creditors and debt collectors from contacting your employer, neighbors, and family. Moreover, you may impose monetary damages on debt collectors if harmed by unfair debt collection procedures in South Dakota.

If you live in Michigan and have debt collectors calling, emailing, or sending letters about an alleged debt, take solace in knowing you have legal rights and protections under both state and federal law, namely MI Comp L § 445 and the Fair Debt Collection Practices Act. Below, we break down these debt collection laws and how they apply to Michigan residents.

Consumers struggling with debt would appreciate an understanding debt collector. Unfortunately, that isn’t always the case. Many debt collectors resort to harassment and other illegal methods to scare consumers into paying debt. Federal and state governments have established laws and regulations to protect you. Understanding these laws can prepare you for debt collection lawsuits and subsequent judgments.

Are you feeling a little stressed about a debt that Eagle Accounts Group, Inc. says you owe? You’ll likely want a few tips on handling the matter without destroying your credit or ending up with a debt lawsuit. While collection agencies aren’t known for being the friendliest organizations, they usually aren’t out to get you. They won’t break your legs or show up in a dark alley, hounding you for money. However, they will send you letters and call you, which can be annoying, especially if you don’t know who they are or have the money to pay them.

Enduring constant phone calls at all hours and receiving menacing letters can be overwhelming, especially when they come from an unscrupulous debt collector. Most people, including those from the Sooner State, find this experience deeply distressing. However, if you're facing this, don't lose hope. Both state and federal laws offer legal safeguards and mandates to support you when dealing with debt collectors. This article provides a comprehensive overview of debt collection laws in Oklahoma, including laws pertaining to the statute of limitations.

Are Rash Curtis and Associates’ phone calls and letters making it hard to get through your day without unnecessary stress? If so, that’s completely understandable. Debt collectors can be a real nuisance, and they’re not exactly known for their compassionate bedside manner. Resolving a debt begins with effective communication and understanding your rights under the Fair Debt Collection Practices Act (FDCPA). In this article, we’ll discuss how to handle the matter and get back to normal.

Understanding how to effectively deal with collections agencies can feel like deciphering a foreign language, leading to stress and confusion. Among these agencies, Diversified Recovery Bureau stands out. If you find yourself trying to settle an outstanding debt with them, it's paramount to approach the situation with knowledge and strategy.

Experiencing numerous phone calls, menacing letters, and various intimidation tactics from an overzealous debt collector can be distressing. However, if you're facing harassment from a debt collection agent in Nebraska, rest assured. Both state and federal laws are in place to safeguard you during interactions with debt collectors.

You’re likely familiar with MARS Inc., the candy conglomerate responsible for tasty treats like Snickers and Skittles. Its products line the checkout aisles of every grocery and convenience store across America, tempting consumers to buy them for a quick sugar rush. However, you probably don’t know who MARS Inc. Collections is, and you likely weren’t expecting a letter or phone call from this debt collector. We’ll discuss a few techniques to get you out of the debt doghouse with MARS.

Getting many phone calls, scary letters, and other threats from a debt collector can be very stressful and upsetting for many people, including those living in Missouri. If a debt collector is chasing you, there are laws in place to keep you safe when talking to them about a late payment. This article provides a comprehensive overview of debt collection laws in Missouri, including laws pertaining to the statute of limitations.

Being in debt isn’t something to be ashamed of. Millions of people have outstanding credit cards and medical obligations they can’t afford to pay, and many of those debts end up with a collection agency like Mid-South Adjustment. After a collection agency obtains the right to collect your debt, it usually sends you letters.

Being hounded by an unscrupulous debt collector is oftentimes a stressful, anxiety-inducing experience. If you are being pursued by such a debt collector and reside in the Bluegrass State, do not give up hope. There are federal legal protections in place designed to assist you when engaging with a debt collector about a delinquent account.

Have you ever heard of FirstPoint Collection Resources? Chances are that if you’re reading this article, you’ve received a collections notice from them. You might wonder whether this is a legitimate debt collection agency and how you should handle the letter. Don’t worry — SoloSuit explains what FirstPoint Collection Resources is and how you should respond.

Disclosing your income is more than just stating a number; it's about understanding what counts and what doesn't and how to ensure your application paints an accurate picture of your financial standing. With countless myths and misconceptions surrounding this topic, this guide aims to demystify the process.

If you’ve recently received a debt collection notice from The Stark Agency, you’re likely wondering whether you should pay it or ignore it. Unfortunately, most debts don’t disappear into thin air, so you’ll likely need to address the matter. Otherwise, The Stark Agency will probably escalate its collection efforts.

Feeling a little concerned about a debt collection notice you received from Meade & Associates? If you are, that’s completely understandable. No one likes dealing with collection agencies, especially ones that call you frequently and send threatening letters. If Meade & Associates is on your back about an old debt, you can take action.

Are you feeling the heat from a debt collection notice from Kenneth Eisen and Associates? If so, you’re not alone. According to Urban Institute, over 70 million Americans have debts in collections. That’s pretty astounding and signals that many people face financial problems every day. Receiving a collections notice from a debt collector is never fun, but there are steps you can take to resolve the issue and move on from it. In this article, we’ll specifically address debts held by Kenneth Eisen and Associates.

If you’re one of the millions of Americans with a debt in collections, you probably feel a sense of dread when you receive a notice from a collector you don’t recognize. Collections agencies frequently purchase outstanding obligations from the companies they service and then attempt to collect payments from consumers.

Dealing with a collections agency like FCO Collections and Outsourcing can be overwhelming, especially if you're unfamiliar with the debt collections process. Whether the debt is related to medical bills, utilities, or any other financial obligation, the important thing is not to panic. You have rights, options, and a number of strategies to resolve the issue. In this article, we’ll break down the steps you should take to resolve your debt with FCO Collections and Outsourcing, but first, what is this company?

Dealing with debt is never an easy experience. And if you've received a summons for a debt collection lawsuit, it's natural to feel overwhelmed. Ignoring it, however, is the worst thing you can do, as it may result in a default judgment against you, impacting your credit score and leading to wage garnishment or property seizure. This blog post aims to guide you through the process of responding to a debt Summons effectively.

If you've decided that you no longer need your American Eagle credit card, whether because you want to simplify your finances, cut down on high-interest payments, or any other reason, you're probably wondering how to go about canceling it. Canceling a credit card can seem like a daunting task, but it doesn't have to be. In this blog post, we'll guide you through the step-by-step process to cancel your American Eagle credit card with ease.

Dealing with debt can be a nerve-wracking experience, especially when a collection agency gets involved. One such company you might have to deal with is Automated Collection Services, Inc. (ACSI-DM1). This post aims to guide you through the process of resolving a debt with ACSI, offering some tips for negotiation and outlining your rights under federal law.

In an era where securing personal loans is increasingly common, but not always straightforward, navigating through lenders and their offerings is crucial. One lender you may have come across in your search is Bright Lending. But what should you be aware of before diving in to a Bright Lending loan? This article breaks down three important aspects to consider before using Bright Lending’s services.

Identity theft is a growing concern in today's digital age. When someone unlawfully obtains and uses your personal information for fraudulent purposes, the emotional and financial fallout can be significant. If you ever find yourself in the unfortunate position of having your identity stolen, it's essential to take immediate, decisive action. Below, we’ll cover 10 steps you can take to respond to the theft of your identity.

Managing finances can be challenging, and sometimes you may find yourself in a situation where you owe money to a collections agency. If ACEI Collections has contacted you about an outstanding debt, you're probably wondering about the best way to navigate this situation. Rest assured, there are steps you can take to manage and potentially resolve this debt. This guide will walk you through the process.

Got a call from Impact Receivables Management and thought it was your chance to become an actor because "you owe a debt to society?" Well, not quite, but you might owe them some cash. Debt can feel like that annoying piece of spinach stuck between your teeth after a meal; you can't ignore it forever.

In the world of finance, the vast array of borrowing options can sometimes leave consumers confused. One of the lesser-known options available to borrowers is the flex loan. This type of loan offers a unique combination of benefits, designed to give consumers more flexibility compared to traditional loans. But what exactly is a flex loan, and how does it work? Let's delve into the specifics.

If you've received a notice from the Gulf Coast Collection Bureau (GCCB) or any other collection agency, it might seem daunting at first. Many questions can arise: Why am I receiving this? How do I handle it? Can I negotiate the debt? This article will help guide you through the process of resolving a debt with GCCB.

Identity theft can be a deeply distressing experience. Beyond the emotional trauma of having one's personal information misused, the legal repercussions can be daunting. Getting sued due for debt that was incurred by someone who stole your identity can seem like adding insult to injury. Here are five steps to take if you're being sued due to identity theft.

Dealing with outstanding debts can be a stressful and overwhelming process. If you've received a letter or a call from Revenue Enterprises LLC, it means they are trying to collect a debt on behalf of a creditor. Resolving this debt doesn't have to be a nightmare. By understanding the process and taking proactive steps, you can navigate through it with clarity and confidence.

JP Receivables Management Partners (JP RMP), previously known as JP Recovery Services, is a well-known debt collection agency often enlisted to help recover outstanding medical debts. If you're a consumer facing this challenge, it's important to understand that resolving debt with JP RMP Services can be a manageable process with the right approach.

Understanding your credit score and the factors that influence it can be complex and overwhelming. This is where myFICO comes into play – a powerful tool that empowers individuals to take control of their credit health. In this blog post, we'll delve into what myFICO is, how it works, and why it's a valuable resource for anyone aiming to achieve financial stability.

Taking control of your financial destiny begins with managing your credit card debt responsibly. Whether you're aiming to eliminate debt, improve your credit score, or simply gain peace of mind, paying off your Destiny credit card is a crucial step in the right direction. Keep reading to learn some effective strategies to manage and ultimately pay off your Destiny credit card.

Dealing with financial challenges, especially when it comes to auto loans, can be overwhelming. If you find yourself in a situation where you're struggling to make payments to Westlake Financial, you might wonder if negotiation is an option. In this blog post, we'll delve into the topic of negotiating with Westlake Financial, discussing the potential benefits, steps to take, and important considerations.

In the realm of contemporary finance, where technological advancements are reshaping conventional practices, Oportun emerges as a distinctive player, offering a unique approach to financial services, particularly targeting underserved communities. However, Oportun also has a history of aggressive debt collection. If you’ve been sued by Oportun, or one of its partner banks, SoloSuit can help you respond to the lawsuit and resolve your debt before going to court. Keep reading to learn more.

Financial challenges can hit anyone at any time. Whether it's due to job loss, unexpected expenses, or other unforeseen circumstances, financial difficulties can lead to situations where debts pile up. When you're unable to pay your debts, companies often hire debt collectors to recover the money you owe them. Debt collectors have a job to do, but it's important to remember that you have rights and legal protections when dealing with them.

In North Dakota, creditors and debt collection agencies are allowed to pursue the collection of unpaid debts and delinquent accounts that have gone into default. Nevertheless, there are statutory limits in place governing what debt collection agencies can, and cannot, do in their pursuit to recover on a debt.

Collection agencies aren’t known for their exceptional reputations, and that’s why federal and state governments regulate their actions. Several laws have been passed to prevent debt collectors from taking actions that abuse or otherwise harm consumers. While all collection agencies must abide by the national Fair Debt Collection Practices Act (FDCPA), Connecticut has some additional laws to protect its residents.

Dealing with relentless calls, menacing letters, and intimidation from a deceitful debt collector is an unsettling ordeal. This unnerving experience is familiar to many, including residents of the Bayou State. If you find yourself being pursued by debt collectors, there are legal provisions under both state and federal law designed to protect you while engaging with a collector about a delinquent account. This article provides a comprehensive overview of debt collection laws in Louisiana, including laws pertaining to the statute of limitations

There is no doubt debt collection is not a popular industry. Abusive debt collectors and scammers have made consumers wary. Fortunately, federal and state governments keep amending debt collection laws as needs arise. But these regulations may only help you if you are familiar with them. For instance, the Fair Debt Collection Practices Act (FDCPA) governs debt collectors’ communications with consumers. The Fair Credit Reporting Act also controls what they can report to the consumer reporting bureaus.

You’ve tried ignoring the daily phone calls. But your debt collector just isn’t taking the hint. It’s gotten to the point where you dread seeing the number pop up on your caller ID. Fortunately, Arkansas residents have rights that protect them from debt collection practices that fall in the category of harassment. Learn more about the debt collection laws in Arkansas and find out how to respond to a persistent debt collector.

Your phone’s been ringing every day for about a week. The caller identifies himself as a debt collector — but you can just ignore him, right? Wrong. If the debt is legitimate, the collection agency may eventually sue you for unpaid debts. But that doesn’t mean that Delaware residents have to be victims of aggressive debt collection practices. Learn more about the laws that protect you and find out how to safely respond to debt collection phone calls.

No one likes dealing with debt collectors. Collection letters usually contain lots of confusing legal terminology that’s likely to make you feel guilty for owing money, and their phone calls can interrupt your busy day. If a collection agency is pursuing you for debt in Idaho, it’s essential to understand what it can and cannot do. That way, you’ll know when a debt collector has infringed on your rights and how to handle it.

One minute, you’re enjoying the glorious spring sunshine, and the next, you find out a collection agency is chasing you for an old debt you’ve long forgotten. A debt collection notice from PRA Group, Inc. can put a crimp in your day. You likely want to learn how to beat PRA Group. After all, you don’t want to be the subject of debt collection letters and phone calls; you have other problems to deal with (and a life to enjoy!).

Finding a lender who will finance small business operations isn’t easy, especially if your company is new and unproven. One company that helps business owners connect with lenders is Click N Loans. Through the service, entrepreneurs can obtain the money they need for business operations. What do customers have to say about Click N Loans? Let’s find out.

Over the past decade, Apple Pay has quickly gained steam, and millions of stores worldwide accept payment via the app. However, consumers occasionally experience problems using Apple Pay, like when a transaction suddenly goes under review. Sued for debt connected to Apple Pay? Use SoloSettle to respond and settle your debts.

Like in all states, debt collection in Tennessee is a common practice that creditors engage in to recover unpaid debts from consumers. Sometimes, they follow the law and act professionally, but often, they violate your consumer rights. As such, Tennessee debt collection laws were put in place to monitor debt collectors' behavior.

Being hounded by an unscrupulous debt collector is oftentimes a stressful, anxiety-inducing experience. If you are being pursued by such a debt collector and reside in Nevada, do not fret. There are state and federal legal protections in place designed to assist you when engaging with a debt collector about a delinquent account.

Illinois residents have certain rights that protect them from harassment at the hands of debt collectors. Understanding these rights can help you push back against aggressive or unscrupulous debt collection practices. And if you’re facing repeated phone calls from a debt collector, it’s important to know how to respond and resolve your debt.

They may call it the Sunshine State, but repeated calls from a debt collector can darken your spirits. If you’re a resident of Florida, you have rights that protect you from aggressive or persistent debt collection agencies. This guide will help you understand Florida's debt collection laws and explain how to respond to unwanted phone calls.

Virginia’s debt collection laws protect consumers from harassment and intimidation. It also limits when, how, and for how long a creditor can follow up on their debt. The law clearly outlines the penalties debt collectors will experience if caught mistreating consumers. In this article, we'll explore Virginia debt collection laws and help you prepare to take action when a debt collector violates your rights.

Should you find yourself pursued by such an abusive debt collection agent or agency, rest assured that there are legal provisions in place, both under Montana law and federal law, to safeguard you while engaging with a debt collector regarding a delinquent account. This article provides a comprehensive overview of debt collection laws in Montana, including laws pertaining to the statute of limitations.

Residents in the Land of Enchantment have access to certain legal rights and protections when it comes to the conduct and actions of debt collectors in their pursuits to collect on a delinquent account. The rights afforded to New Mexico residents are described in the federal Fair Debt Collection Practices Act (FDCPA) and the New Mexico Fair Debt Collection Practices Act (NMFDCPA). Let’s take a look at each law.

Are you being hounded by a relentless debt collector? Does the sound of your phone make you cringe? If you’re a resident of Arizona, you have laws that protect you from aggressive collection practices. Understanding the debt collection laws in Arizona will equip you to deal with debt collectors, and SoloSuit can help you settle your debts and even respond to a debt collection lawsuit.

It is not unusual for debt collectors in Washington to annoy and harass consumers for a pending debt. Fortunately, Washington has functional debt collection laws that protect consumers from having to endure such situations. In this article, we’ll explain these debt collection laws and how they apply to your situation, plus the actions you should take if a debt collector violates your rights.

Debt collectors often grow impatient when they follow up on debt. Some go a step further and use illegal means to convince or scare you to pay. Fortunately, consumers in Rhode Island do not have to tolerate these unlawful practices. The state has laws that regulate how debt collectors conduct business. These debt-collection laws protect debtors from being harassed, misled, deceived, or experiencing unfair practices.

Debt collectors are nothing if not persistent, and in some cases, they can be downright aggressive, even in the relative paradise of Hawaii. The good news is that you’re not alone. SoloSuit has helped countless individuals settle their debts and rebuild their credit. First, you need to learn about and take advantage of Hawaii laws that protect you from intimidation, harassment, and deceptive debt collection practices.

The Fair Debt Collection Practices Act (FDCPA) and Ohio Fair Debt Collection Practices Act are laws designed to protect consumers from unfair, unethical and improper debt collection practices in Ohio. In this article, we’ll break down these laws in detail and explain how you can stand up for your rights against debt collectors.

West Virginia can help you fight for your rights and stop the unending harassment by debt collectors. West Virginia debt collection laws cover various issues such as when, how, and for how long debt collectors can follow you up for debt. It also states how much they can take from your wages if they get a garnishment order. However, it is possible to avoid getting to this stage by responding to the initial debt collection lawsuit with a written Answer.

You can use SoloSuit to respond to a debt lawsuit, file a Motion to Compel Arbitration, or settle the debt before going to court. Join our live webinars to ask your own questions about how to resolve a debt lawsuit. The following is a transcript for one of our webinars. In it, SoloSuit's founder George Simons responds to live questions from consumers.

If you keep up with your regular payments in Alabama, you’re unlikely to encounter any issues with your creditors. However, if something happens that prevents you from paying your creditors, you’ll run into problems. Eventually, they may give up on you and sell your debts to a collection agency. Collection agencies aren’t known for being exceptionally forgiving. When they get hold of an unpaid debt, they’ll ratchet up the collection efforts, and you’ll likely start receiving letters and phone calls.

Unfortunately, you can’t stop a debt collector from purchasing debt from your original creditor, especially if you’re behind on payments. However, you have rights that protect you from a debt collector’s abusive actions. If a collection agency is chasing you for an old obligation, it’s smart to brush up on the debt collection laws in Colorado so that you know how to protect yourself.

Debt collection letters are incredibly frustrating, especially if you know you owe the money but don’t have enough to repay it. If you receive one, you know that more will come, along with many phone calls and emails. Debt collectors aren’t known for being the most reputable of characters, and some collection agencies may use illegal tactics to collect debts. Remember, no one can harass or abuse you, even if you owe them money.

As a resident of Alaska, you need to understand your rights if a debt collector is chasing you for money. Collection agencies aren’t known for being the most reputable businesses, and if an old account of yours ends up in a collection agency’s hands, you’ll probably start receiving lots of phone calls and letters. Fortunately, both the federal and state government offer protections from debt collectors for Alaska residents.

Dealing with a debt collection agency like Consumer Collection Management (CCM) can be an intimidating and stressful experience if you have fallen behind on your debts. To impress their clients, CCM sometimes resorts to aggressive and even unlawful tactics to ensure you pay the debt. It is essential as a consumer to know your rights and understand how to protect yourself from illegal debt collection practices. This article will help you deal with CCM at any stage of the collection process.

Being pursued by a debt collector is generally considered to be an unpleasant experience that routinely triggers people to be stressed, anxious, and concerned every time the phone rings. If you are being contacted by a debt collector and are a resident of the Beaver State, do not fret. There are legal protections codified under Oregon law and under federal law to help you when engaging with a debt collector about a delinquent account.

Persistent calls and letters from Nationwide Credit can be frustrating. Even worse, the debt collector may threaten to sue. For consumers, it is easy to go into panic mode. But panicking can cause you to act unwisely. SoloSuit helps you respond to Nationwide Credit on time, settle debts you owe for less, and win debt-collection lawsuits. This article discusses who Nationwide Credit is and who it collects for, the company's customer reviews, your rights under the FDCPA, and how to resolve a debt with the company.

Wage garnishment can be a stressful and mentally exhausting experience for consumers in New Jersey facing financial challenges. When creditors obtain a court order to collect debts through wage garnishment, a portion of your wages is withheld, leaving you with reduced take-home pay.

However, debt collectors in New Jersey must follow strict laws that give directions on the type of income they can garnish, the process involved, and limits to garnishment.

Receiving a debt collection notice in the mail probably isn’t the highlight of your day. No one likes unexpected expenses, especially when they’re long-forgotten or you don’t believe you owe them. Unfortunately, debt collection is a big business in the US, and creditors aren’t likely to let you off the hook too easily. One well-known collection agency, Encore Capital Group, purchases overdue consumer credit and utility debts and pursues debtors for the amount they owe.

Thousands of Texans may endure financial struggles — many due to wage garnishment. Certain creditors can try to collect on debts owed by withholding a debtor's wages. This can impact the debtor's income and make it more difficult for these people to pay their expenses. Thankfully, Texas wage garnishment laws protect its residents from unfair garnishment orders and practices. Examples include garnishment limitations, exemptions, debt settlement, and bankruptcy. In this article, we’ll break down each of these options and more.

A debtor’s worst nightmare is finding themselves with a garnishment order that seeks to take away the money that barely meets their daily necessities. In Oklahoma, consumers have laws that protect them from wage garnishment that may plunge them deeper into financial hardship. Without helpful resources to guide you, it may feel impossible to resolve your debt. Luckily, Oklahoma law gives you a way to fight garnishment orders, and SoloSuit can help you respond to a debt lawsuit and avoid wage garnishment through debt settlement.

The federal government has a lot of protections in place for consumers who borrow money on credit. One is USC 15 Section 1662(b), which protects individuals from creditors who make certain claims about consumer credit. Understanding your rights under USC 15 Section 1662(b) can protect you from dodgy lenders who try to separate you from your wallet.

If you struggle to make ends meet and are already having difficulty managing your finances, receiving a wage garnishment order is a devastating blow. You may feel overwhelmed and worried about how you will make ends meet. Fortunately, the state of Washington has laws to protect consumers from excessive wage garnishment. The provisions limit how much and which debts can be garnished. There are also certain procedures the creditor must follow before garnishing your wages.

When a B2B organization doesn’t receive the money it expects from its customers, it does what any B2B company would — it tries to get them back on track with their payments. It will call the debtor business and send letters in an attempt to collect the money it’s owed. However, sometimes these efforts don’t work, and the business will contact a collection agency, like Atradius Collections, that specializes in collecting money for B2B organizations.

Receiving a debt collection notice is the absolute worst. You’re going about your day one minute, and the next minute, BAM! Someone claims you owe money you might not have the funds to repay. Unfortunately, if your debt ends up with Unifin, you can expect lots of collection notices, emails, and phone calls until you resolve the situation. If you don’t repay the bill or set up a payment arrangement, Unifin may decide to take further action with a debt lawsuit.

A court often issues a garnishment order to a creditor after they win a debt collection case.

While it's true that Oregon’s wage garnishment laws limit a creditor's opportunity to garnish your wages, some provisions still allow them to get their money legally. If you have received a garnishment notice, you can still fight it. This article will explain the various ways to stop wage garnishment. But first, let us look at the wage garnishment laws in Oregon.

You can use SoloSuit to respond to a debt lawsuit, file a Motion to Compel Arbitration, or settle the debt before going to court. Join our live webinars to ask your own questions about how to resolve a debt lawsuit. The following is a transcript for one of our webinars. In it, SoloSuit's founder George Simons responds to live questions from consumers.

How do you feel about debt collection agencies? If you’re a consumer on the receiving end of their letters and phone calls, your impression of them probably isn’t too positive. Our list of the largest collection agencies in 2023 identifies some of the major players in the collection industry. While we can’t stop them from harassing you, we can provide you with some background so you can be prepared.

Excessive wage garnishment can have long-term consequences, such as damage to credit scores and difficulty obtaining a loan in the future. Fortunately, Virginia provides ways to stop wage garnishment. You can object to the garnishment order, file a claim of exemption, negotiate a payment plan with the creditor, or file for bankruptcy. This article will explain these options.

In the era of increasing financial complexity, many individuals and businesses alike find themselves entangled in the web of debts. However, adopting a comprehensive approach to debt management can make this challenge less intimidating. This involves creating a robust debt repayment plan — a plan that works for you, rather than against you.

Once you receive the garnishment order, you will have several days to challenge it in court or negotiate with the creditor. This article will help you learn what to do in either of these options. We will discuss Virginia wage garnishment laws and look at the various ways you can stop wage garnishment or prevent it entirely.

If a debt collector calls you, they’ll interrupt your busy day and leave you in a bad mood. Fortunately, consumers have protections against debt collectors under 15 USC 1692, known as the Fair Debt Collections Practices Act (FDCPA). Congress enacted the FDCPA in 1977, and it has been amended several times since then.

You can use SoloSuit to respond to a debt lawsuit, file a Motion to Compel Arbitration, or settle the debt before going to court. Join our live webinars to ask your own questions about how to resolve a debt lawsuit. The following is a transcript for one of our webinars. In it, SoloSuit's founder George Simons responds to live questions from consumers.

Unlike many states, South Carolina does not allow wage garnishment for consumer debts. Such creditors may threaten consumers with wage garnishment, but they will never legally enforce it. Debts that lead to garnishment are those you owe the state or federal government, child or spousal support, and those with a judgment and withholding order from your previous state of residence.

Consumers must understand New Mexico's laws, especially if they face wage garnishment for the first time. A clear picture of the process can open several ways to handle the situation. New Mexico wage garnishment laws are public. So you can access them whenever you need to. However, many consumers may need help comprehending the complex legalese on government websites. This article breaks down the technical jargon and formal terminologies in a way you can understand. By examining the applicable laws, you will find ways out of a wage garnishment order.

If a creditor wins a lawsuit against you, you can look forward to a judgment and possible wage garnishment. In wage garnishment, your creditor will gain the right to take part of your income until you fully satisfy the debt. The portion of your paycheck seized will likely be higher than if you had stuck with your original payment arrangement. Avoid wage garnishment through debt settlement.

When you’re struggling to keep up with your regular debt payments, you may wonder what will happen if you stop paying your creditors. Will your debts disappear into a black hole? Will your creditors suddenly forget about you and stop calling you? Unfortunately, that’s wishful thinking. Creditors seldom forget when someone owes money, and they’re likely to step up their collection efforts if you stop paying your bills. Continued nonpayment can result in a debt lawsuit. If your creditor wins a debt lawsuit against you, it will obtain a judgment they can use for wage garnishment.

If a creditor decides to sue you for unpaid debt, you can’t afford to ignore it. A debt lawsuit opens the door for further legal ramifications, like wage garnishment. If your creditor wins the legal claim, it will receive a judgment against you, which it can use to require your employer to withhold part of your income until you repay the debt. Wage garnishment is no joke, especially in Idaho. Idaho has rigid wage garnishment laws that work to your creditor’s advantage. If your creditor gains the right to garnish your wages, you’ll see a significant portion of your earnings go straight to your creditor, making it much harder to afford other things you need, like shelter and groceries.

Birds are chirping, the sun is shining, and everything seems wonderful — until you find a summons for a debt lawsuit on your Arizona front porch. You'll want to act quickly if you’re the subject of a debt lawsuit. If you lose the case, your creditors will win a judgment they can use to garnish your pay or seize other assets, like your bank account. A wage garnishment requires your employer to withhold part of your weekly income until you satisfy a debt. The amount of a wage garnishment varies depending on state laws, your earnings, and the total you owe. Generally, the more you earn and the higher your debt, the greater the garnishment amount.

If you’re behind on debt in Missouri, you may wonder what the potential consequences are. You know that your creditor probably isn’t going to let you off the hook, so what’s the next tactic that it will use against you? Creditors and collection agencies typically follow the same pattern when someone stops paying their bills. They’ll start sending letters, and you may receive more phone calls from unknown numbers. These efforts at communication will continue for a while until they decide you’re not going to reply.

It’s not uncommon to fall behind on your bills. Most everyone has been guilty of missing a few payments. However, if you don’t get control of the situation quickly, your creditors will start hounding you — and they won’t stop until they get the money you owe. What starts as a few missed payments can lead to a debt lawsuit. The lawsuit's outcome may be a judgment that your creditors can use to garnish your wages. Wage garnishment takes a significant chunk of your income, impacting your ability to pay for other things, like food and rent.

Debtors facing wage garnishment in Tennessee have several ways out, thanks to the state and federal consumer protection laws that are in place. Tennessee's wage garnishment law protects some of your income from debt collectors. So creditors cannot take your entire salary even if you have multiple garnishments or a huge judgment amount to pay. Although the regulations closely mimic federal wage garnishment laws, there are a few notable differences. In this article, we will discuss those statutes.

Wage garnishment occurs when a creditor seizes a portion of your wages to satisfy a debt. The creditor will continue to take part of your income until you repay your obligation. Wage garnishments can last weeks, months, or even years, depending on how much you owe and how much you earn. It’s important to realize that wage garnishments aren’t automatic. If you stop paying your bills, your creditors can’t suddenly swoop down and force your employers to hand over part of your paycheck. Instead, they must sue you and win a judgment from your local court to start the garnishment.

Student loans are an integral part of the US education system. They facilitate access to higher education, equalize opportunity, and are considered an investment in one’s future. Despite the benefits of student loans, the crushing weight is overwhelming for many individuals. High debt amounts and interest affect the borrower’s financial stability and repayment. In this article, we will discuss financial tips for college students, bits of advice on how to overcome financial problems, and how to fix student loan debt.

The average American has thousands of dollars in debt, which includes credit card debt, student loans, mortgages, and auto loans. With such a large amount of debt, it is not uncommon for consumers to receive debt collection calls. You have rights under the FDCPA and can ask the debt collection agency to cease harassing communications and validate the debt. Use SoloSuit's online resources if you are unsure where to begin if you need assistance, mainly if the matter goes to court.

When you have trouble making your monthly payments to creditors, they’ll usually try to work with you, especially if you’re facing an unexpected issue, like job loss or health problems. They may allow you to make smaller payments or forgive late fees for a few months. Problems occur when you can’t get back on track with your payments. Your creditor will increase its collections efforts with calls and letters, but it may give up at some point. It will probably decide to sue you or sell your debt to a collections agency that will expedite the payment process.

Northstar Location Services is a debt collection agency that provides first and third-party debt collection services. If Northstar has contacted you about a debt, ask them to validate it before taking any other action. However, if Northstar Location Services has sued you, you can settle the debt once and for all with the help of SoloSettle.

Alorica Inc. is a customer service agency that partners with companies in various industries, including debt collection. Recently, Alorica purchased Expert Global Solutions, a collection agency based in Pennsylvania. SoloSuit makes it easy to respond to a debt lawsuit against Alorica and settle your debts once and for all.

You can use SoloSuit to respond to a debt lawsuit, file a Motion to Compel Arbitration, or settle the debt before going to court. Join our live webinars to ask your own questions about how to resolve a debt lawsuit. The following is a transcript for one of our webinars. In it, SoloSuit's founder George Simons responds to live questions from consumers.

Advanced Recovery Systems is a debt collection agency that knows how to pressure you to pay the debt you owe its clients. ARS will call multiple times a day, send multiple emails, or sue you. But you can still engage with them at any stage of the collection process. You can ask them to validate a debt, respond to a debt lawsuit and win in court, or settle your debt with Advanced Recovery Systems with the help of SoloSettle.

You probably didn’t expect to receive a collection notice from The Moore Law Group. Collection notices tend to show up when you least expect them, ruining your day. While your first instinct may be to throw the collection notice in the garbage, it’s best to address the issue head-on. That way, you avoid the legal repercussions that may raise their ugly heads. Sued by The Moore Law Group? Settle your debt and move on with your life.

You can use SoloSuit to respond to a debt lawsuit, file a Motion to Compel Arbitration, or settle the debt before going to court. Join our live webinars to ask your own questions about how to resolve a debt lawsuit. The following is a transcript for one of our webinars. In it, SoloSuit's founder George Simons responds to live questions from consumers.

Owing a creditor money can make anyone feel a little anxious, especially if they don’t have the means to make regular payments.

Financial problems can quickly spiral out of control, resulting in late fees, penalties, and extra interest. If you don’t get on top of the matter fast, your creditor may take more drastic action, like suing you for unpaid debt. Act quickly if a creditor decides to sue you. Losing a debt lawsuit can result in a judgment against you that your creditor can use to garnish your wages or even freeze your bank account.

If you currently owe a debt in California, you may be worried about wage garnishment. A wage garnishment requires your employer to withhold a portion of your weekly earnings on behalf of your creditor. The garnishment continues until you fully satisfy the debt you owe. Wage garnishment is pretty serious stuff. If your creditor is successful, it will take a significant chunk of your income away from you. That will make it difficult to pay for your daily needs, support your family, and afford a place to live. Fortunately, creditors can’t garnish your wages in California without going through some legal hoops.

Wage garnishment can leave individuals unable to meet their debt obligations and can be a financially devastating experience for many families in the United States. Utah wages can be garnished legally if the creditor obtains a court order, leaving those in debt feeling helpless and overwhelmed. After a creditor has obtained a court order against an individual, indicating that they are legally entitled to collect the sought debt, wages can be garnished in a legal process in which a creditor can collect by taking money directly out of an individual's paycheck. Wage garnishment can be a scary reality for many, as it limits the cash available each month for the individual to take home.

If you owe money to a creditor in Alabama, you don’t want to end up on the receiving end of a debt lawsuit. Alabama has some of the strictest wage garnishment laws in the nation, and a creditor who wins a judgment against you can take a considerable portion of your pay until you satisfy your debt. You don’t want to fork over your earnings to a creditor, so it’s best to resolve the claim before it ends in a judgment against you. In this article, explain how the wage garnishment laws work in Alabama and what you can do to protect yourself.

You can use SoloSuit to respond to a debt lawsuit, file a Motion to Compel Arbitration, or settle the debt before going to court. Join our live webinars to ask your own questions about how to resolve a debt lawsuit. Without SoloSuit, people win less than 10% of the time in debt collection lawsuits. We consider a win to be a few things. One, if your case just gets dismissed outright, two, you might settle your lawsuit, or three, you might buy yourself more time in the lawsuit so that you can declare bankruptcy or something else along those lines.

Few things are worse than finding out your old obligation is with a debt collector like Lakeside Collection. Lakeside Collection, also known as Lakeside Receivables LLC or Lakeside Recovery Solutions, is a collection agency that tries to recover unpaid debts from consumers. Lakeside Collection doesn’t have much of an online presence. Its website offers minimal contact information and a short About Us page. If Lakeside Collection is causing trouble, you’re in the right place. We’ll explain how to handle your situation and avoid legal repercussions.

Old Navy is a value shopper’s dream. It offers clothing for the entire family that’s of decent quality at low prices. Many customers turn to Old Navy for their favorite jeans, sweatshirts, and other attire. Loyal customers obtain an Old Navy credit card, which they can use in-store and at partner retailers, including Gap, Banana Republic, and Athleta. However, all relationships can turn sour — even with a seemingly innocuous store like Old Navy. If you fall behind on your Old Navy credit card payments, you may be the subject of a debt lawsuit, something you probably don’t want.

Best Buy is known for selling just about any consumer electronics you might need, such as TVs, home theater equipment, computers, laptops, and washing machines. Many customers visit their local Best Buy store or website when they need a new device. Electronics aren’t cheap. A laptop can cost over $1K, and smartphones can set you back at least $750. Many people don’t have much savings, so they use credit cards for help. Best Buy offers two different credit card programs clients can use to purchase what they need. However, people who fall behind on their payments face repercussions, including lawsuits.

The American Credit Acceptance company, headquartered in Spartanburg, South Carolina, provides financing solutions for subprime consumers. Consumers can secure automotive loans through ACA. As a partner of over 2,500 dealers, the company has provided affordable vehicle options to more than 630,000 consumers.

At SoloSuit, we converse daily with people who have negative monetary net worth and have been sued by the world’s largest multi-billion dollar banks. We wanted to know the prospects of these people, our customers, and people like them. So, we wrote this report. The goal of this report is to compare previous trends in debt collection cases to current trends and to predict debt collection lawsuits to come as a reflection of the US economy’s current state.

Wage garnishment can be a stressful and overwhelming experience for anyone who is already struggling with debt. In Nevada, creditors can garnish up to 25% of a debtor's disposable income, making it difficult for some debtors to make ends meet. Fortunately, legal protections are available to help debtors stop or reduce a wage garnishment. These protections include objecting to wage garnishment, filing a claim of exemption, negotiating with the creditor, or filing for bankruptcy.

If you’re a business owner, you might have borrowed a business loan from a bank or other lender to get your business off the ground or fund expensive operations. If so, your business’s debt to sales ratio becomes a key metric of your company’s financial health and an indicator of potential actions you may have to undertake. If you’re considering taking out a business loan or have already taken one out, understanding your debt-to-sales ratio is paramount to guiding your business’s long-term financial plan. To help you out, this guide will explain what a debt-to-sales ratio is and give advice on how to manage it.

When you have several bills to pay on top of paying off a new car or credit card, things can get overwhelming. Sometimes debt can spiral out of control, making it difficult to get out, especially if you have high-interest loans or accounts. One of the most effective ways to manage this debt is by obtaining a debt consolidation loan, and Priority Plus Financial says debt consolidation helps you manage your debts more efficiently. By consolidating your debts and accounts, you can pay less interest and make one monthly payment.

In Ohio, consumers with long-standing unpaid debts often face wage garnishment—a legal process permitting creditors to collect money directly from your paycheck. Wage garnishment can result in significant financial hardship for individuals and families, leaving you with a reduced income to cover your living expenses. However, if you face wage garnishment in Ohio, you can fight the garnishment order. Ohio law provides guidelines to help you stop or minimize wage garnishment and regain control of your finances. This article will discuss Ohio laws and examine ways to stop wage garnishment.

When you owe money to a creditor, they may take legal action to collect the debt when you fail to pay. If a creditor wins a debt collection case against you, they can then obtain a court order to garnish your wages. Garnishment can cause extreme financial hardship for consumers struggling to pay the bills. A wage garnishment order requires your employer to withhold a percentage of your wages and send it to the creditor.

Creditors tend to freak out when you stop making regular payments. They may tolerate it for a few months, but you’ll probably incur late fees, making it even harder to get caught up on your debt. If you stop answering creditors’ phone calls and don’t try to resolve the issue, they’ll step up their collection efforts and may even sue you. If you receive a Summons for a Connecticut debt lawsuit against you, you must take action fast. A debt lawsuit indicates that a creditor or debt collector wants to obtain a judgment so it can garnish your wages. Avoiding a judgment is critical to prevent wage garnishment. Without a judgment, no creditor can take your pay.

Getting a collection notice means that your creditor decided to sell your debt to a professional collection agency, and you’ll probably hear from it frequently in the coming months. Debt collectors take the collections process seriously — after all, their entire business model is collecting old debts and pursuing consumers for payment. While you can’t stop a creditor from charging off your unpaid medical debt and selling it to a collection agency, it helps to know how the process works. In some cases, you may be able to use it to your advantage.

You open your mailbox and find a few advertisements, a magazine, and what appears to be a letter from a collection agency. Debt collection notices can come at the most inconvenient times, reminding you of your failure to pay a bill. The collection letter you receive is for a $200 balance on your old Visa card. You’ve long forgotten about the debt, but the collection agency hasn’t! Will it sue you if you don’t pay? That depends on several factors, including the amount you owe, the age of the debt, and whether you attempt to communicate with the collection agency.

Being sued for credit card debt is not a good feeling, and it can be pretty isolating. You may have already gone online to look for an attorney to represent you in the case and discovered that it's expensive, time consuming, and a pretty complicated process to find a lawyer. Luckily, Solo Suit exists to help people like you represent yourself in court and feel less alone throughout the debt collection lawsuit process. In this article, we're going to show you an interview that I recently had with a real SoloSuit customer who used our services to fight off a major debt collection agency and credit card company in court. His name is Mason from South Carolina, and here's how he beat Zwicker & Associates Discover credit card in court.

In Wyoming, a wage garnishment order can be issued by a court or a government agency, directing an employer to withhold a portion of your wages to pay off a debt. Dealing with wage garnishment can be an overwhelming and stressful experience for anyone. Fortunately, options are available to stop wage garnishment in Wyoming. Taking action to stop the garnishment can provide much-needed relief and reduce financial stress. This article will discuss three ways to reduce or stop wage garnishment. Before we get to it, here are Wyoming garnishment laws you must consider.

Getting sued for debt is stressful enough, but imagine being taken to court over a fraudulent credit card debt. At SoloSuit, our mission is to empower people who are struggling with debt by helping them respond to debt collectors and debt collection lawsuits on their own, making justice accessible to all. Recently, one of our employees interviewed a real SoloSuit user who was sued by American Express for a $35,000 credit card debt—a debt she didn’t incur. In this article, she shares her story on how she used SoloSuit to respond to a fraudulent credit card lawsuit and win, all in her own words.

When you stop paying a credit card company or another creditor, like a utilities or telecommunications provider, it will try to get you back on track with your payments. If you don’t respond to these efforts, your creditor will likely charge off your account. A charge-off will wreck your credit score, and a charged-off account will likely end up in the hands of a collection agency. Creditors often sell charged-off debts to collection agencies, especially when they think it's unlikely that the consumer will repay the entire debt. Once the collection agency buys the debt, it will resume collection efforts against the consumer, which may include a debt lawsuit.