How to Make a Motion to Compel Arbitration

Patrick Austin, J.D. | January 30, 2025

Edited by Hannah Locklear

Editor at SoloSuit

Hannah Locklear, BA

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Fact-checked by George Simons, JD/MBA

Co-Founder of SoloSuit

George Simons, JD/MBA

George Simons is the co-founder and CEO of SoloSuit. He has helped Americans protect over $1 billion from predatory debt lawsuits. George graduated from BYU Law school in 2020 with a JD/MBA. In his spare time, George likes to cook, because he likes to eat.

Summary: To file a motion to compel arbitration, draft a Petition with background facts, arbitration agreement details, and lawsuit parties. File at court, serve notice to the other party, and attend the hearing. Ensure your dispute falls within the contract's arbitration provision.

If you were served with a debt collection lawsuit and are terrified at the prospect of having to go to argue and make an argument before a judge, do not fret. You have options. For example, it may be possible to resolve the debt collection lawsuit before going to court through an alternative form of dispute resolution. An effective form of dispute resolution that takes place outside the courtroom is arbitration.

What is debt collection arbitration?

Debt collection arbitration is a private process outside of the court. It involves an agreement between the disputing parties in a legal case to empower one or more neutral individuals to render decisions about the legal dispute after listening to the arguments and receiving the evidence. This individual is known as an arbitrator.

Arbitrators take fairness and impartial oath and apply the law just like the judges. However, unlike the judges, arbitrators are answerable to the parties involved in the dispute. They are also handpicked by the individuals involved in the conflict. On the other hand, judges are elected or appointed by government officials.

Many agreements and contracts contain arbitration clauses. As a result, several state and federal laws allow an individual to compel for arbitration. However, you'll need to make sure that you have a valid arbitration agreement for this to happen.

Sued for debt? Respond with SoloSuit.

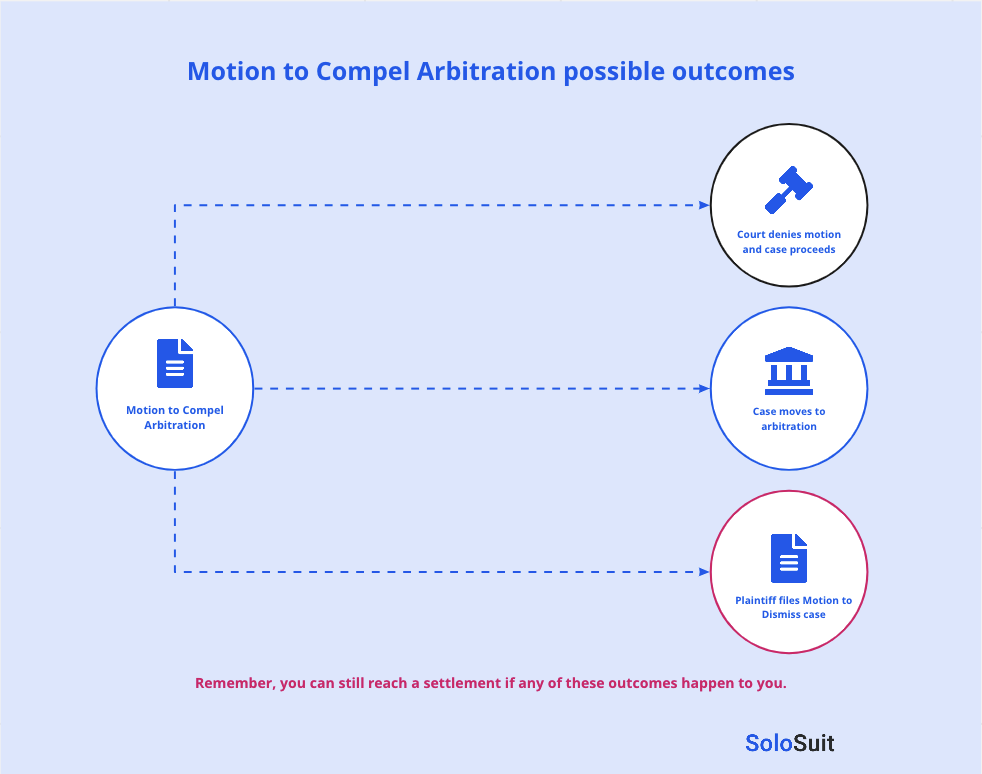

Now, here are the possible outcomes of filing a motion to compel arbitration:

How to file a motion to compel arbitration

If you have sufficient background facts and texts of the arbitration agreement, consider following the procedures below to compel arbitration.

1. Draft a Petition to Compel Arbitration

According to Section 4 of the Federal Arbitration Act, you can file a petition compelling arbitration without waiting for the other party to sue you. Your pleading should have the title 'Petition to Compel Arbitration.' It should also contain the following information:

- Sufficient background facts

- Statements of the arbitration agreement

- Lawsuit parties identifications

- Court's jurisdiction over the lawsuit

- Request for an arbitration order

- Your signature

2. File your petition

Check with the court clerk about petition filing requirements and file the original petition. You should include a notice of hearing within five days.

3. Serve the notice to the other party

Be sure to include the following:

- Copy of your complaint

- Notice of hearing

- Summons

When serving the other party, be sure to follow the correct methods of service.

4. Attend the hearing

Based on the issues provided, the judge will decide on the validity of the arbitration agreement. If these issues are not in dispute, the judge will issue an arbitration order.

Depending on your particular situation, you may want to contact the debt collector who is suing you and determine if they are willing to participate in the arbitration to resolve the dispute. If they are not willing to voluntarily participate in arbitration, you have the option to file a motion to compel arbitration.

If you want to compel participation in arbitration, it is important to make sure that the legal dispute falls within the parameters of the arbitration provision in the relevant contract (e.g., credit card agreement, personal loan agreement, car loan agreement, etc.). For example, some arbitration agreements contain exceptions or exclusions for what is covered. A contract might require arbitration for compensatory disputes but not for disputes related to the quality of work completed in a project.

Decide if you should make a motion to compel arbitration

Before filing a motion to compel arbitration, consider the following:

1. Arbitration provisions in the initial contractual agreement

Consider checking your contract to confirm that you have a valid arbitration agreement. It's almost impossible to bring to action a compelling motion arbitration if you don't have a good arbitration agreement.

Arbitration provisions contain clauses that bind the parties in a contractual agreement to resolve their issues using an arbitration process rather than the court system. The clause states the arbitration tribunal's location and always requires any court with competent jurisdiction to confirm the award.

To compel your debt collector into participating in arbitration, ensure that the legal dispute falls within the parameters stated by the arbitration provision in the contract. For instance, some arbitration agreements may contain exclusions or exceptions for what is covered. A contract might require arbitration for missing out on one payment but not debt defaulted.

2. Location of the arbitration tribunal

If your argument is eligible for arbitration, it is important to determine the best location for the process. The arbitration provision includes such details.

3. Type of court to pursue arbitration

Another thing to address is whether to pursue arbitration in a state court or a federal court. The Federal Arbitration Act (FAA) ensures judicial facilitation of private dispute resolution through arbitration.

It applies in both federal and state courts. However, many individuals consider filing the motion in federal courts because such courts have a firm policy of ruling in favor of arbitration.

To learn more about how filing a motion to compel arbitration can help you settle your debt lawsuit, check out this video:

What is the difference between arbitration vs lawsuit?

Does the idea of going to court for a debt lawsuit stress you? Arbitration lets you settle the debt outside of a traditional court setting. It's much less intimidating than going to court, and most debt collectors would rather dismiss the case than take it to arbitration. If you got so far behind on your credit card payments that the credit card company is now suing you, you can file a motion to compel arbitration to resolve the issue outside of court. All credit card agreements contain a section that outlines details about arbitration. This is known as the arbitration clause. You should carefully review the arbitration clause in your credit card's terms and conditions before deciding if arbitration is a good move for you. You can search for your card or bank's agreement here.

Arbitration and mediation differ in empowering and awarding authority to the neutral third party. In arbitration, the arbitrator has the power to render a decision considered to be final in resolving the dispute.

The conflicting parties agree on the settlement arrived at by the arbitrator. Evidence and arguments are highly regarded and written, and an arbitration award issued later.

In mediation, the conflicting parties retain the right to decide whether to agree or not to the mediator's settlement. A mediator only tries to encourage the disputing parties to work together by providing alternative directives and opinions, with the sole objective of reaching common ground with a mutually satisfying solution.

Unlike mediation, arbitration is more formal; it follows legal rules and procedures. In mediation, the disputing parties might fail to reach a common ground and end up back in the courts afterward.

Make the right defense the right way with SoloSuit.

For a conflict resolution process to be considered as arbitration, it must have the following characteristics:

The arbitration process is private; disclosures on submissions made or the information in those submissions and the awards given during the process are not allowed.

Before the process begins, parties involved in the dispute must agree to carry out the arbitral tribunal's final decision without delay.

Before the process begins, the parties involved ensure neutrality by:

These mutual decisions ensure that none of the parties involved has an advantage over the other.

This process can only happen if both parties have agreed to it. Should a future dispute occur involving the same parties under the contract, either of the disputing parties will insert an arbitration clause under the relevant contract. Unlike mediation, a party cannot unilaterally withdraw from the arbitration process.

JAMS Solutions and American Arbitration Association (AAA) are two of the leading arbitration organizations in the US. If your motion to compel arbitration has been accepted by the court, it is very likely that your arbitration case will involve one of these two organizations. According to JAMS, the arbitration process is as follows: Both parties choose an impartial person (arbitrator) who arbitrates the case by reading briefs and documentary evidence, listening to parties' testimonies, examing evidence, and offering an "award of the arbitrator" (which includes any relief, damages, outcome, or attorney/courts costs and fees deemed necessary by the arbitrator). The arbitrator must render the award within 30 days of the arbitration hearing. Finally, the award can be entered as a judgment in law after proper confirmation with the court. Filing a motion to compel arbitration can be a great option for someone who is sued for debt. In many cases, the debt collector is required to cover arbitration costs, and such costs can end up being more than the amount they are trying to recover. As a result, many debt collectors would rather dismiss the case than continue with the arbitration process. This is the ideal outcome for a defendant who has filed a motion to compel arbitration. On the other hand, if the arbitration clause states that both parties must split the cost of arbitration fees, a case dismissal may not be as likely. Many credit agreements list the creditor as the party responsible for arbitration fees, should a debt lawsuit case move to arbitration. This means that many creditors are contractually bound to pay arbitration fees and cannot seek to recover them if they win, which leaves you off the hook!

However, if your credit agreement does not explicitly state that the creditor would be responsible for fees in an arbitration case, then the cost for arbitration would be split between you and the creditor by default. In arbitration between an employee and employer, the employer must cover the costs but can recover them if they win. Additionally, some credit agreements give the creditor the right to recover arbitration fees if they win, so be sure to carefully read your credit agreement when considering arbitration. See the table below for JAMS' filing fees and AAA's filing fees: Watch the following video to learn more about what happens during arbitration and attorney tips that will help you prepare for your arbitration hearing.

>>Read the NPR story on SoloSuit: A Student Solution To Give Utah Debtors A Fighting Chance

Here's a list of guides on how to respond to a debt collection lawsuit in each state:

Are you being sued by a debt collector? We’re making guides on how to resolve debt with each one.

Some creditors, banks, and lenders have an internal collections department. If they come after you for a debt, Solosuit can still help you respond and resolve the debt. Here’s a list of guides on how to resolve debt with different creditors.

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

If the thought of going to court stresses you out, you’re not alone. Many Americans who are sued for credit card debt utilize a Motion to Compel Arbitration to push their case out of court and into arbitration.

Below are some resources on how to use an arbitration clause to your advantage and win a debt lawsuit.

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.

Knowing your rights makes it easier to stand up for your rights. Below, we’ve compiled all our articles on federal debt collection laws that protect you from unfair practices.

We’ve created a specialized guide on how to find debt relief in all 50 states, complete with steps to take to find relief, state-specific resources, and more.

Debt collection laws vary by state, so we have compiled a guide to each state’s debt collection laws to make it easier for you to stand up for your rights—no matter where you live.

Like all debt collection laws, the statute of limitations on debt varies by state. So, we wrote a guide on each state’s statutes. Check it out below.

Statute of Limitations on Debt Collection by State (Best Guide)

Don’t have time to go to your local courthouse to check the status of your case? We’ve created a guide on how to check the status of your case in every state, complete with online search tools and court directories.

Forgot to respond to your debt lawsuit? The judge may have ordered a default judgment against you, and with a default judgment, debt collectors can garnish your wages. Here are our guides on how to stop wage garnishment in all 50 states.

Debt settlement is one of the most effective ways to resolve a debt and save money. We’ve created a guide on how to settle your debt in all 50 states. Find out how to settle in your state with a simple click and explore other debt settlement resources below.

Not sure how to negotiate a debt settlement with a debt collector? We are creating guides to help you know how to start the settlement conversation and increase your chances of coming to an agreement with every debt collector.

We give a factual review of the following debt consolidation, debt settlement, and loan organizations and companies to help you make an informed decision before you take on a debt.

Debt has a big impact on your credit. Below is a list of guides on how to repair and improve your credit, even while managing major debt.

Struggling with student debt? SoloSuit’s got you covered. Below are resources on handling student loan debt.

You can represent yourself in court. Save yourself the time and cost of finding an attorney, and use the following resources to understand legal definitions better and how they may apply to your case.

"Finding yourself on the wrong side of the law unexpectedly is kinda scary. I started researching on YouTube and found SoloSuit's channel. The videos were so helpful, easy to understand and encouraging. When I reached out to SoloSuit they were on it. Very professional, impeccably prompt. Thanks for the service!" - Heather

Credit card arbitration

What is the difference between arbitration and mediation?

Characteristics of arbitration

1. Confidentiality of the process

2. Finality of the arbitrator's decision

3. Arbitration Is neutral

4. Arbitration is a consensual procedure

JAMS Solutions and American Arbitration Association (AAA) are two major arbitration companies

Who pays for arbitration in a debt lawsuit?

How to Answer a Summons for debt collection in all 50 states

Guides on how to resolve debt with every debt collector

Resolve your debt with your creditor

Settle your medical debt

Guides on arbitration

Stop calls from debt collectors

Federal debt collection laws can protect you

Get debt relief in your state

Debt collection laws in all 50 states

Statute of limitations on debt state guides

Check the status of your court case

How to stop wage garnishment in your state

Other wage garnishment resources

How to settle a debt in your state

How to settle with every debt collector

Other debt settlement resources

Personal loan and debt relief reviews

How to repair and improve your credit score

How to resolve student loan debt

Civil law legal definitions

Get answers to these FAQs on debt collection

How-to debt guides

Learn more with these additional debt resources

It only takes 15 minutes.

And 50% of our customers' cases have been dismissed in the past.

Get Started