Here’s a Sample Letter to Collection Agencies to Settle Debt

Sarah Edwards | April 11, 2024

Edited by Hannah Locklear

Editor at SoloSuit

Hannah Locklear, BA

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Fact-checked by George Simons, JD/MBA

Co-Founder of SoloSuit

George Simons, JD/MBA

George Simons is the co-founder and CEO of SoloSuit. He has helped Americans protect over $1 billion from predatory debt lawsuits. George graduated from BYU Law school in 2020 with a JD/MBA. In his spare time, George likes to cook, because he likes to eat.

Summary: Settling your debt is possible. You can draft your own debt settlement letter using our sample letter below, or start the debt negotiation process with SoloSettle to get the ball rolling on settling your debt.

Is a debt collector pursuing you for an old debt you wish was long behind you? If so, you may try to settle the obligation. Under debt settlement, you agree to pay a certain amount to the collection agency. In exchange, the collection agency accepts your payment and writes off the remaining balance.

Debts settle for 48% of the original value if the matter has not escalated to litiation yet. If there is a lawsuit filed over the debt, the average debt settlement amount increases to 85%. Collection agencies are usually more willing to accept a settlement if your debt is old and past the statute of limitations.

Collection agencies cannot sue you for a debt that passes the statute of limitations. The statute of limitations will vary depending on your state but generally ranges from two to five years.

To get the ball rolling on settling your debt, you’ll want to send the collection agency a written offer for settlement.

Debt settlement letters help resolve debts

Debt settlement is when you negotiate with your creditor and come to agreement to pay off a portion of your debt and be forgiven for the rest. Debt settlement letters are known to help start the negotiation process.

What should I include in my offer to settle a debt?

You’ll want to include specific information concerning your account in your debt settlement letter.

List your name, account information, the original creditor of the debt, and the debt collection agencies identifying information. Include the current amount you owe and the amount you’d like to offer to settle the debt.

Most importantly, request a debt settlement agreement letter that declares the debt will be reported as paid to all the credit reporting bureaus once you’ve fulfilled your side of the agreement. To summarize, include these points in your debt settlement letter:

Your offer to settle the debt should be clear and straightforward. It should express that you’re willing to offer partial payment to eliminate the obligation.

How much should I offer in my debt settlement letter?

60% is a good place to start, but the amount varies based on your financial situation and the collection agency who is suing you.

Like we mentioned before, the average debt settlement is 48% for pre-lawsuit debts and 85% for debt lawsuits, but note that each debt circumstance is unique. In our experience, however, debt collectors and law firms are more likely to accept a settlement of around 70%.

Most collection agencies purchase old debts from creditors for a small fraction of their original value. It’s not uncommon for collectors to pay only 5 or 10% of a debt in exchange for the right to pursue collection activities against you.

Let's look at a debt settlement example.

Example: If you have an old credit card balance of $5K with JP Morgan and decide to sell it to a debt collector, the collection agency may pay only $250 to $500 for your balance. JP Morgan will provide the collector with basic information about your account, like your contact details and the balance due. Once the collection agency owns your account, they’ll send you letters and start calling you to obtain the original value you owe. You can stop further collection activity by offering to settle the debt for a fair price. Offer what you feel you can afford to pay and see if the collection agency is willing to accept.

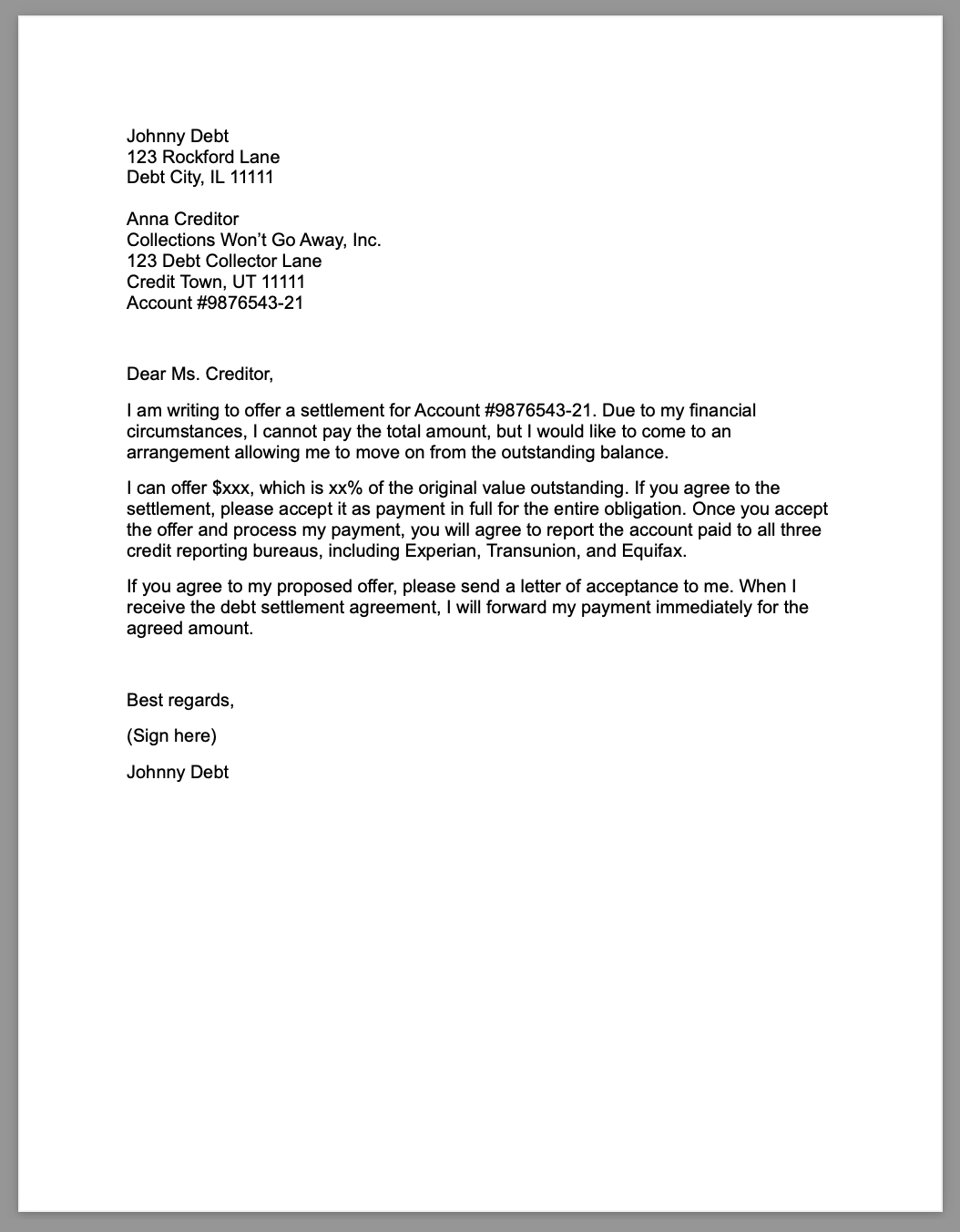

Use this sample debt settlement letter

You might be wondering how to write a good settlement offer letter. We’ve got you covered.

SoloSettle uses a tech-based approach to draft and send settlement offers to creditors and debt collectors. The offer letter includes all the important legal wording necessary to protect your rights and show collectors that you know your stuff.

Alternatively, you can use this settlement sample letter to help you draft one on your own:

Does the collection agency have to accept my settlement offer?

No, they do not have to accept your offer. However, most collection agencies are willing to take less for your obligation, especially if they don’t think you’ll be able to pay the entire amount.

If the collection agency believes they have grounds to sue you for the debt in court, they may pursue a lawsuit against you. If that is the case, you can still potentially settle the account on your own with the help of SoloSettle.

In most cases, working with a collection agency can prevent your account from snowballing into a lawsuit. Debt collectors are often willing to come to a favorable arrangement if you initiate the process, even if it’s before they take you to court. You’ll be able to move on without fear of harassing phone calls or stressful letters.

Use SoloSettle to settle your debt on your own

SoloSettle’s goal is to empower you to negotiate and reach a debt settlement on your own.

With SoloSettle, negotiating a settlement becomes easy due to our structured process. Use our web-app to send and receive offers from collectors. SoloSettle drafts offers for you and protects you from the potential lies and bullying of debt collectors.

Most importantly, SoloSettle makes sure all of the proper legal language is included to protect your rights when communicating with the creditor or debt collector. When a settlement agreement is reached, SoloSettle manages the settlement agreement documentation for you and protects your sensitive financial information from the collectors, preventing them from over-charging you.

Avoid working with debt settlement companies, who don’t always have your best interest at heart.

Check out this review from a real SoloSettle customer:

“I'm very thankful for SoloSettle. Having a third party negotiate the settlement was instrumental in resolving this case and saved me from two giant headaches: 1) I didn't have to deal with the plaintiff's lawyer and 2) I didn't have to go to court. I also love that the payment was processed through SoloSettle. I was nervous about sharing my personal financial data with the other side, but SoloSettle protected that for me. I hope I never get sued again, but if I do, I would use SoloSettle again in a heartbeat. SoloSettle really saved me a ton of time and heartburn and kept me from having to be my own lawyer in court.” - Dan

Settle your debt on your own with SoloSettle.

Check out this video to learn more about how to settle a debt:

What is Solo?

Solo makes it easy to resolve debt with debt collectors.

You can use SoloSuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt. SoloSuit's Answer service is a step-by-step web-app that asks you all the necessary questions to complete your Answer. Upon completion, we'll have an attorney review your document and we'll file it for you.

SoloSettle can help you contact your debt collector or creditor and negotiate the debt to settle for less, all online. It simplifies and streamlines the process to settling your debt.

No matter where you find yourself in the debt collection process, Solo is here to help you resolve your debt.

>>Read the NPR story on SoloSuit. (We can help you in all 50 states.)

How to Answer a Summons for debt collection in all 50 states

Here's a list of guides on how to respond to a debt collection lawsuit in each state:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont; Vermont (Small Claims court)

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Guides on how to resolve debt with every debt collector

Are you being sued by a debt collector? We’re making guides on how to resolve debt with each one.

- 11 Charter Communications

- AAA Collections

- Aargon Agency Inc

- Absolute Resolutions Investments LLC

- ACEI Collections

- Account Services

- Accredited Collection Services

- Accredited Collection Services

- Advanced Recovery Systems

- AES NCT

- AFNI Collections

- Alco Capital Group LLC

- Aldous and Associates

- Alliance Collections

- Alliance One

- Alliant Capital Management

- Alpha Recovery Corp

- Alltran Financial

- Alltran Health

- Alorica Inc.

- Amcol Clmbia in Court

- American Coradius International

- American Profit Recovery

- American Recovery Service

- Americollect

- AmSher Collection Services

- Apelles LLC

- AR Resources

- ARC Collections

- ARM Solutions

- Arrow Financial Services

- ARS National Services

- ARSC Debt Collectors

- ARS National Services

- ARstrat

- AscensionPoint Recovery Services

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Atlantic Credit and Finance

- Atradius Collections

- Automated Collection Services, Inc.

- Autovest LLC

- Avante USA

- Avantus

- AWA Collections

- Balekian Hayes

- Bay Area Receivables

- BCA Financial Services

- BC Services

- Benuck and Rainey

- Berlin-Wheeler

- Bluebonnet Financial LLC

- Bonneville Collections

- Bull City Financial

- Bureaus Investment Group

- Cach LLC

- Caine and Weiner

- Capio Partners

- Capital Accounts

- Capital Collections

- Capital Management Services

- CardWorks

- Carmel Financial/New Coast Direct

- Cavalry SPV I LLC

- CBCInnovis

- CBCS Collections

- CBE Group

- CBV Collections

- CCB Credit Services

- CCS Collections

- CCS Offices

- Central Mediation Services

- Central Portfolio Control

- Cerastes LLC

- Choice Recovery

- Choice Recovery Inc

- CKS Financial

- CKMS Financial

- Client Services

- CMRE Financial Services

- COAF

- Coast Professional

- Comenity Bank Debt Collection

- Commonwealth Financial

- ConServe Debt Collection

- Consumer Collection Management

- Contract Callers Inc

- Convergent Healthcare Recoveries

- Convergent Outsourcing

- Couch Conville & Blitt

- Covington Credit

- CRDT First

- Credco in Court

- Credence Resource Management

- Credit Bureau Systems

- Credit Control Corporation

- Credit Management Company

- Credit Management LP

- Credit Systems

- Credit Systems

- CSIEZPay

- CTC Debt Collector

- CVCS Debt Collection

- Cypress Financial Recoveries

- D&A Services

- Daniels, Norelli, Cecere & Tavel P.C.

- DCM Services

- Debt Recovery Solutions

- Delanor Kemper & Associates

- Department Stores National Bank

- Direct Recovery Associates

- Discover Collections

- Diversified Adjustment

- Diversified Consultants

- Diversified Recovery Bureau

- DNF Associates, LLC

- Dodeka LLC

- DRS Credit

- Dynamic Collectors

- Eagle Loan

- Eagle Accounts Group, Inc.

- Eastern Account System

- EduCap

- Ellington and Associates Collections

- Encore Capital Group

- Enerson Law

- Enerson Law LLC

- Enhanced Recovery Company

- EOS CCA

- ERC Collections

- ERSolutions

- Estate Information Services

- Equable Ascent Financial

- Everest Business Funding

- Executive Credit Management

- Faber and Brand

- Factual Data

- Falls Collection Service

- FBCS

- FCO Collections and Outsourcing

- FIA Card Services

- fin rec svc (Financial Recovery Services)

- First Federal Credit Credit Control

- First Financial Bank

- First Portfolio Ventures LLC

- First Progress

- FirstPoint Collection Resources

- Firstsource Advantage

- FMA Alliance

- FNB Omaha

- Forster & Garbus

- Franklin Collection Services

- Freedom Plus

- Freshview Solutions

- Frontline Asset

- Frost Arnett

- Fulton Friedman & Gullace LLP

- Galaxy International Purchasing, LLC

- GC Debt Collection

- GC Services

- General Revenue Corporation

- GLA Collections

- Glass Mountain Capital

- Glasser and Glasser

- Global Credit Collection Corp

- Global Trust Management

- GMAC Financing

- Golden 1 Credit Union

- Grant and Weber

- Grant Mercantile Agency

- Gulf Coast Collection Bureau

- Gurstel

- Halsted Financial Services

- Harris and Harris

- Harvard Collection

- Harvest Credit Management

- Helvey and Associates

- Hollis Cobb

- Holloway Moxley

- Hosto Buchan

- Howard Lee Schiff

- H&R Accounts

- HRRG

- Hudson & Keyse LLC?

- Hunter Warfield

- IC System

- Impact Receivables Management

- Innovative Recovery

- Integras Capital Recovery LLC

- Javitch Block

- JHPDE Finance 1 LLC

- JP Receivables Management Partners

- JPMCB card

- Kenneth Eisen and Associates

- KeyBank student loans

- Kinum

- Kirschenbaum, Phillips & Levy P.C.

- KLS Financial Services

- Kramer & Frank

- Lakeside Collection

- Lending Club

- Lincoln and Morgan Kabbage

- Linebarger Goggan Blair & Sampson LLP

- Lockhart Collection Agency

- LJ Ross Associates

- LTD Collections

- Malcolm S. Gerald and Associates

- Malen & Associates

- Mandarich Law Group

- Mannbracken

- Marcam Associates

- MARS Inc. Collections

- MBA Law

- MCA Management Company

- McCarthy, Burgess & Wolff

- Meade & Associates

- Medicredit

- Mercantile Adjustment Bureau

- Merchants Credit Association

- MGM Collections

- Michael J Adams PC

- Midland Funding LLC

- Mid-South Adjustment

- Monarch Recovery

- Monterey Financial

- Moss Law Firm

- Mountain Land Collections

- MRS Associates

- MRS BPO

- MSW Capital LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Nathan and Nathan PC

- National Collegiate Trust

- National Credit Adjusters

- National Credit Care

- National Credit Systems

- National Enterprise Systems

- National Recovery Agency

- National Recovery Solutions

- Nationstar

- Nationwide Credit

- Nationwide Recovery Services

- Nationwide Recovery Systems

- NCEP LLC

- NCO Financial Systems Incorporated

- North American Recovery

- Northland Group

- Northstar Capital Acquisition

- Northstar Location Services

- NPAS

- NRC Collection Agency

- Oliver Adjustment Company

- Oliphant Financial, LLC

- Oportun

- P&B Capital Group

- PCB Collections Agency

- Palisades Collection LLC

- Pallida LLC

- Paragon Contracting Services

- Paragon Revenue Group

- Payday Loan Debt Collectors

- Pendrick Capital Partners

- Penn Credit

- Perdue Brandon

- Persolve LLC

- Phillips & Cohen Associates

- Phoenix Financial Services

- Pioneer Credit Recovery

- PMAB LLC

- PRA Group, Inc.

- Pressler, Felt & Warshaw LLP

- Prestige Services, Inc.

- Prince Parker and Associates

- ProCollect

- Professional Finance Company

- Progressive Management Systems

- Provest Law

- PYOD LLC

- Quaternary Collection Agency

- RAB Collection Agency

- Rash Curtis and Associates

- Radius Global SOL

- Radius Global Solutions

- Rawlings Company

- Razor Capital

- Real Time Resolutions

- Receivables Performance Management

- Regents and Associates

- Reliant Capital Solutions

- RentGrow

- Resurgent

- Resurgent Capital Services and LVNV Funding

- Revco Solutions

- Revenue Enterprises LLC

- Revenue Group

- RGS Financial, Inc.

- RMP LLC in Court

- RMP Services

- RS Clark and Associates

- RSIEH

- RSIEH

- RTR Financial Services

- Rubin & Rothman

- Salander Enterprises LLC

- Samara Portfolio Management

- SCA Collections

- Scott Parnell and Associates

- Second Round Collections

- Second Round Sub LLC

- Selip & Stylianou LLP

- Sequium Asset Solutions

- Sessoms and Rogers

- Sherman Acquisition

- Sherman Financial Group

- SIMM Associates

- Source Receivables Management

- Southern Management Systems

- Southwest Credit Group

- Spire Recovery Solutions

- SRS Company

- Stark Collection Agency

- State Collection Service

- Stenger and Stenger

- Stillman Law Office

- Summit Account Resolution

- Sunrise Credit Services

- Superlative RM Debt Collector

- Suttell and Hammer

- Synergetic Communication

- Synerprise Consulting

- The Law Office of Michael J Scott

- Trellis Company

- Troy Capital

- TRS Recovery Services

- TrueAccord

- Tulsa Teachers Credit Union

- UCB Collection

- UHG 1, LLC

- Unifin

- Unifin Debt Collector

- Unifund

- Universal Credit Services

- US Bank Collections

- USAA collections

- USCB America

- Valentine and Kebartas

- Valley Servicing

- Vance & Huffman LLC

- Van Ru Credit Corporation

- Velo Law Office

- Velocity Investments

- Viking Client Services

- Wakefield and Associates

- Waypoint Resource Group

- WCTCB

- Weinberg and Associates

- Weltman, Weinberg & Reis

- Westwood Funding

- Williams and Fudge

- Wilshire Consumer Credit

- Wolpoff & Abramson

- Worldwide Asset Purchasing

- www.AutomotiveCredit.com

- Zarzaur & Schwartz

- Zwicker & Associates

Resolve your debt with your creditor

Some creditors, banks, and lenders have an internal collections department. If they come after you for a debt, Solosuit can still help you respond and resolve the debt. Here’s a list of guides on how to resolve debt with different creditors.

- American Express; American Express – Debt Collection

- Bank of America

- Barclay

- Best Buy Credit Card

- Capital One

- Chase

- Credit One Bank

- Old Navy Credit Card

- PayPal Synchrony Card

- Regional Finance

- Retailers National Bank

- Reunion Student Loan Finance Corporation

- SYNCB/PPEXTR

- Synchrony Bank

- Synchrony Walmart Card

- Target National Bank

- Webbank

- Wells Fargo

- Can I Pay My Original Creditor Instead of a Debt Collection Agency?

- Can I Settle a Debt with the Original Creditor?

Settle your medical debt

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

- Am I Responsible for My Spouse's Medical Debt?

- Do I Need a Lawyer for Medical Bills?

- Do I Need a Lawyer to Fight Medical Bill Debt?

- Does Bankruptcy Clear Medical Debt?

- How Much Do Collection Agencies Pay for Medical Debt?

- How to Find Medical Debt Forgiveness Programs

- Is There a Statute of Limitations on Medical Bills?

- Medical Debt Statute of Limitations by State

- Summoned to Court for Medical Bills — What Do I Do?

- Summoned to Court for Medical Bills? What to Do Next

Guides on arbitration

If the thought of going to court stresses you out, you’re not alone. Many Americans who are sued for credit card debt utilize a Motion to Compel Arbitration to push their case out of court and into arbitration.

Below are some resources on how to use an arbitration clause to your advantage and win a debt lawsuit.

- How Arbitration Works

- How to Find an Arbitration Clause in Your Credit Agreement

- How to Make a Motion to Compel Arbitration

- How to Make a Motion to Compel Arbitration in Florida

- How to Make a Motion to Compel Arbitration Without an Attorney

- How Credit Card Arbitration Works

- Motion to Compel Arbitration in California

- Sample Motion to Compel Arbitration

Stop calls from debt collectors

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.

- 1-800-390-7584

- 800-289-8004

- 800-955-6600

- 8009556600

- 877-366-0169

- 877-591-0747

- 800-278-2420

- 800-604-0064

- 800-846-6406

- 877-317-0948

- 888-899-4332

- 888-912-7925

- 202-367-9070

- 502-267-7522

Federal debt collection laws can protect you

Knowing your rights makes it easier to stand up for your rights. Below, we’ve compiled all our articles on federal debt collection laws that protect you from unfair practices.

- 15 USC 1692 Explained

- Does the Fair Credit Reporting Act Work in Florida?

- FDCPA Violations List

- How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

- How to Make a Fair Debt Collection Practices Act Demand Letter

- How to Submit a Transunion Dispute

- How to Submit an Equifax Dispute

- How to Submit an Experian Dispute

- What Debt Collectors Cannot Do — FDCPA Explained

- What Does Account Information Disputed by Consumer Meets FCRA Requirements Mean?

- What does “meets FCRA requirements” mean?

- What does FCRA stand for?

- What is the Consumer Credit Protection Act

Get debt relief in your state

We’ve created a specialized guide on how to find debt relief in all 50 states, complete with steps to take to find relief, state-specific resources, and more.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Debt collection laws in all 50 states

Debt collection laws vary by state, so we have compiled a guide to each state’s debt collection laws to make it easier for you to stand up for your rights—no matter where you live.

- Debt Collection Laws in Alabama

- Debt Collection Laws in Alaska

- Debt Collection Laws in Arizona

- Debt Collection Laws in Arkansas

- Debt Collection Laws in California

- Debt Collection Laws in Colorado

- Debt Collection Laws in Connecticut

- Debt Collection Laws in Delaware

- Debt Collection Laws in Florida

- Debt Collection Laws in Georgia

- Debt Collection Laws in Hawaii

- Debt Collection Laws in Kansas

- Debt Collection Laws in Idaho

- Debt Collection Laws in Illinois

- Debt Collection Laws in Indiana

- Debt Collection Laws in Iowa

- Debt Collection Laws in Kentucky

- Debt Collection Laws in Louisiana

- Debt Collection Laws in Massachusetts

- Debt Collection Laws in Michigan

- Debt Collection Laws in Minnesota

- Debt Collection Laws in Mississippi

- Debt Collection Laws in Missouri

- Debt Collection Laws in Montana

- Debt Collection Laws in Nebraska

- Debt Collection Laws in Nevada

- Debt Collection Laws in New Hampshire

- Debt Collection Laws in New Jersey

- Debt Collection Laws in New Mexico

- Debt Collection Laws in New York

- Debt Collection Laws in North Carolina

- Debt Collection Laws in North Dakota

- Debt Collection Laws in Ohio

- Debt Collection Laws in Oklahoma

- Debt Collection Laws in Oregon

- Debt Collection Laws in Pennsylvania

- Debt Collection Laws in Rhode Island

- Debt Collection Laws in South Carolina

- Debt Collection Laws in South Dakota

- Debt Collection Laws in Tennessee

- Debt Collection Laws in Texas

- Debt Collection Laws in Vermont

- Debt Collection Laws in Virginia

- Debt Collection Laws in Washington

- Debt Collection Laws in West Virginia

- Debt Collection Laws in Wisconsin

- Debt Collection Laws in Wyoming

Statute of limitations on debt state guides

Like all debt collection laws, the statute of limitations on debt varies by state. So, we wrote a guide on each state’s statutes. Check it out below.

Statute of Limitations on Debt Collection by State (Best Guide)

- Statute of Limitations on Debt Collection in Alabama

- Statute of Limitations on Debt Collection in Alaska

- Statute of Limitations on Debt Collection in Arizona

- Statute of Limitations on Debt Collection in Arkansas

- Statute of Limitations on Debt Collection in California

- Statute of Limitations on Debt Collection in Connecticut

- Statute of Limitations on Debt Collection in Colorado

- Statute of Limitations on Debt Collection in Delaware

- Statute of Limitations on Debt Collection in Florida

- Statute of Limitations on Debt Collection in Georgia

- Statute of Limitations on Debt Collection in Hawaii

- Statute of Limitations on Debt Collection in Illinois

- Statute of Limitations on Debt Collection in Indiana

- Statute of Limitations on Debt Collection in Iowa

- Statute of Limitations on Debt Collection in Kansas

- Statute of Limitations on Debt Collection in Louisiana

- Statute of Limitations on Debt Collection in Maine

- Statute of Limitations on Debt Collection in Maryland

- Statute of Limitations on Debt Collection in Michigan

- Statute of Limitations on Debt Collection in Minnesota

- Statute of Limitations on Debt Collection in Mississippi

- Statute of Limitations on Debt Collection in Missouri

- Statute of Limitations on Debt Collection in Montana

- Statute of Limitations on Debt Collection in Nebraska

- Statute of Limitations on Debt Collection in Nevada

- Statute of Limitations on Debt Collection in New Hampshire

- Statute of Limitations on Debt Collection in New Jersey

- Statute of Limitations on Debt Collection in New Mexico

- Statute of Limitations on Debt Collection in New York

- Statute of Limitations on Debt Collection in North Carolina

- Statute of Limitations on Debt Collection in North Dakota

- Statute of Limitations on Debt Collection in Oklahoma

- Statute of Limitations on Debt Collection in Oregon

- Statute of Limitations on Debt Collection in Oregon (Complete Guide)

- Statute of Limitations on Debt Collection in Pennsylvania

- Statute of Limitations on Debt Collection in Rhode Island

- Statute of Limitations on Debt Collection in South Carolina

- Statute of Limitations on Debt Collection in South Dakota

- Statute of Limitations on Debt Collection in Tennessee

- Statute of Limitations on Debt Collection in Texas

- Statute of Limitations on Debt Collection in Utah

- Statute of Limitations on Debt Collection in Vermont

- Statute of Limitations on Debt Collection in Virginia

- Statute of Limitations on Debt Collection in Washington

- Statute of Limitations on Debt Collection in West Virginia

- Statute of Limitations on Debt Collection in Wisconsin

- Statute of Limitations on Debt Collection in Wyoming

Check the status of your court case

Don’t have time to go to your local courthouse to check the status of your case? We’ve created a guide on how to check the status of your case in every state, complete with online search tools and court directories.

- Alabama Court Case Search—Find Your Lawsuit

- Alaska Court Case Search — Find Your Lawsuit

- Arizona Court Case Search - Find Your Lawsuit

- Arkansas Court Case Search — Find Your Lawsuit

- California Court Case Search- Find Your Lawsuit

- Colorado Court Case Search — Find Your Lawsuit

- Connecticut Case Lookup — Find Your Court Case

- Delaware Court Case Search — Find Your Lawsuit

- Florida Court Case Search — Find Your Lawsuit

- Georgia Court Case Search — Find Your Lawsuit

- Hawaii Court Case Search — Find Your Lawsuit

- Idaho Court Case Search – Find Your Lawsuit

- Illinois Court Case Search — Find Your Lawsuit

- Indiana Court Case Search — Find Your Lawsuit

- Iowa Court Case Search — Find Your Lawsuit

- Kansas Court Case Search — Find Your Lawsuit

- Kentucky Court Case Search — Find Your Lawsuit

- Louisiana Court Case Search — Find Your Lawsuit

- Maine Court Case Search — Find Your Lawsuit

- Maryland Court Case Search — Find Your Lawsuit

- Massachusetts Court Case Search — Find Your Lawsuit

- Michigan Court Case Search — Find Your Lawsuit

- Minnesota Court Case Search — Find Your Lawsuit

- Mississippi Court Case Search — Find Your Lawsuit

- Missouri Court Case Search — Find Your Lawsuit

- Montana Court Case Search — Find Your Lawsuit

- Nebraska Court Case Search — Find Your Lawsuit

- Nevada Court Case Search — Find Your Lawsuit

- New Hampshire Court Case Search — Find Your Lawsuit

- New Jersey Court Case Search—Find Your Lawsuit

- New Mexico Court Case Search - Find Your Lawsuit

- New York Case Search — Find Your Lawsuit

- North Carolina Court Case Search — Find Your Lawsuit

- North Dakota Court Case Search �� Find Your Lawsuit

- Ohio Court Case Search — Find Your Lawsuit

- Oklahoma Court Case Search — Find Your Lawsuit

- Oregon Court Case Search — Find Your Lawsuit

- Pennsylvania Court Case Search — Find Your Lawsuit

- Rhode Island Court Case Search — Find Your Lawsuit

- South Carolina Court Case Search — Find Your Lawsuit

- South Dakota Court Case Search — Find Your Lawsuit

- Tennessee Court Case Search — Find Your Lawsuit

- Texas Court Case Search — Find Your Lawsuit

- Utah Court Case Search — Find Your Lawsuit

- Vermont Court Case Search — Find Your Lawsuit

- Virginia Court Case Search — Find Your Lawsuit

- Washington Court Case Search — Find Your Lawsuit

- West Virginia Court Case Search — Find Your Lawsuit

- Wisconsin Court Case Search — Find Your Lawsuit

- Wyoming Court Case Search — Find Your Lawsuit

How to stop wage garnishment in your state

Forgot to respond to your debt lawsuit? The judge may have ordered a default judgment against you, and with a default judgment, debt collectors can garnish your wages. Here are our guides on how to stop wage garnishment in all 50 states.

- Stop Wage Garnishment in Alabama

- Stop Wage Garnishment in Alaska

- Stop Wage Garnishment in Arizona

- Stop Wage Garnishment in Arkansas

- Stop Wage Garnishment in California

- Stop Wage Garnishment in Colorado

- Stop Wage Garnishment in Connecticut

- Stop Wage Garnishment in Delaware

- Stop Wage Garnishment in Florida

- Stop Wage Garnishment in Georgia

- Stop Wage Garnishment in Hawaii

- Stop Wage Garnishment in Idaho

- Stop Wage Garnishment in Illinois

- Stop Wage Garnishment in Indiana

- Stop Wage Garnishment in Iowa

- Stop Wage Garnishment in Kansas

- Stop Wage Garnishment in Kentucky

- Stop Wage Garnishment in Louisiana

- Stop Wage Garnishment in Maine

- Stop Wage Garnishment in Maryland

- Stop Wage Garnishment in Massachusetts

- Stop Wage Garnishment in Michigan

- Stop Wage Garnishment in Minnesota

- Stop Wage Garnishment in Mississippi

- Stop Wage Garnishment in Missouri

- Stop Wage Garnishment in Montana

- Stop Wage Garnishment in Nevada

- Stop Wage Garnishment in New Hampshire

- Stop Wage Garnishment in New Jersey

- Stop Wage Garnishment in New Mexico

- Stop Wage Garnishment in New York

- Stop Wage Garnishment in North Carolina

- Stop Wage Garnishment in North Dakota

- Stop Wage Garnishment in Ohio

- Stop Wage Garnishment in Oklahoma

- Stop Wage Garnishment in Oregon

- Stop Wage Garnishment in Pennsylvania

- Stop Wage Garnishment in Rhode Island

- Stop Wage Garnishment in South Carolina

- Stop Wage Garnishment in South Dakota

- Stop Wage Garnishment in Tennessee

- Stop Wage Garnishment In Texas

- Stop Wage Garnishment In Utah

- Stop Wage Garnishment in Vermont

- Stop Wage Garnishment in Virginia

- Stop Wage Garnishment in Washington

- Stop Wage Garnishment in West Virginia

- Stop Wage Garnishment in Wisconsin

- Stop Wage Garnishment in Wyoming

Other wage garnishment resources

- Bank Account Garnishment and Liens in Texas

- Can I Stop Wage Garnishment?

- Can My Wife's Bank Account Be Garnished for My Debt?

- Can Payday Loans Garnish Your Wages?

- Can pensions be garnished?

- Can Private Disability Payments Be Garnished?

- Can Social Security Disability Be Garnished?

- Can They Garnish Your Wages for Credit Card Debt?

- Can You Stop a Garnishment Once It Starts?

- Guide to Garnishment Limits by State

- How Can I Stop Wage Garnishments Immediately?

- How Long Before a Creditor Can Garnish Wages?

- How Long Does It Take to Get Garnished Wages Back?

- How to Fight a Wage Garnishment

- How to Prevent Wage Garnishment

- How to Stop a Garnishment

- How to Stop Social Security Wage Garnishment

- How to Stop Wage Garnishment — Everything You Need to Know

- New York Garnishment Laws – Overview

- Ohio Garnishment Laws — What They Say

- Wage Garnishment Lawyer

- What Is Wage Garnishment?

How to settle a debt in your state

Debt settlement is one of the most effective ways to resolve a debt and save money. We’ve created a guide on how to settle your debt in all 50 states. Find out how to settle in your state with a simple click and explore other debt settlement resources below.

- How to Settle a Debt in Alabama

- How to Settle a Debt in Alaska

- How to Settle a Debt in Arizona

- How to Settle a Debt in Arkansas

- How to Settle a Debt in California

- How to Settle a Debt in Colorado

- How to Settle a Debt in Delaware

- How to Settle a Debt in Florida

- How to Settle a Debt in Hawaii

- How to Settle a Debt in Idaho

- How to Settle a Debt in Illinois

- How to Settle a Debt in Indiana

- How to Settle a Debt in Iowa

- How to Settle a Debt in Kansas

- How to Settle a Debt in Kentucky

- How to Settle a Debt in Louisiana

- How to Settle a Debt in Maryland

- How to Settle a Debt in Massachusetts

- How to Settle a Debt in Michigan

- How to Settle a Debt in Minnesota

- How to Settle a Debt in Mississippi

- How to Settle a Debt in Missouri

- How to Settle a Debt in Montana

- How to Settle a Debt in Nebraska

- How to Settle a Debt in Nevada

- How to Settle a Debt in New Hampshire

- How to Settle a Debt in New Jersey

- How to Settle a Debt in New Mexico

- How to Settle a Debt in New York

- How to Settle a Debt in North Carolina

- How to Settle a Debt in North Dakota

- How to Settle a Debt in Ohio

- How to Settle a Debt in Oklahoma

- How to Settle a Debt in Oregon

- How to Settle a Debt in Pennsylvania

- How to Settle a Debt in South Carolina

- How to Settle a Debt in South Dakota

- How to Settle a Debt in Tennessee

- How to Settle a Debt in Texas

- How to Settle a Debt in Utah

- How to Settle a Debt in Vermont

- How to Settle a Debt in Virginia

- How to Settle a Debt in West Virginia

- How to Settle a Debt in Wisconsin

- How to Settle a Debt in Wyoming

How to settle with every debt collector

Not sure how to negotiate a debt settlement with a debt collector? We are creating guides to help you know how to start the settlement conversation and increase your chances of coming to an agreement with every debt collector.

Other debt settlement resources

- Best Debt Settlement Companies

- Can I Settle a Debt After Being Served?

- Can I Still Settle a Debt After Being Served?

- Can You Settle a Warrant in Debt Before Court?

- Debt Management vs. Debt Settlement

- Debt Settlement Pros and Cons

- Debt Settlement Scam

- Do I Need to Hire a Debt Settlement Lawyer?

- Do You Need a Debt Settlement Attorney in Houston Texas?

- Do You Owe Taxes on Settled Debt?

- Here’s a Sample Letter to Collection Agencies to Settle Debt

- How Can I Settle My Credit Card Debt Before Going to Court?

- How Do I Know if a Debt Settlement Company Is Legitimate?

- How Long Does a Lawsuit Take to Settle?

- How Much Do Settlement Companies Charge?

- How I Settled My Credit Card Debt With Discover

- How to File a Motion to Enforce Settlement Agreement

- How to Make a Debt Settlement Agreement

- How to Make a Settlement Offer to Navient

- How to Negotiate a Debt Settlement with a Law Firm

- How to send Santander a settlement letter

- How to Settle Debt for Pennies on the Dollar

- How to Settle Debt in 3 Steps

- How to Settle Debt with a Reduced Lump Sum Payment

- How to Settle a Credit Card Debt Lawsuit — Ultimate Guide

- How to Settle Credit Card Debt When a Lawsuit Has Been Filed

- If You Are Using a Debt Relief Agency, Can You Settle Yourself with the Creditor?

- Largest Debt Settlement Companies

- Should I Settle a Collection or Pay in Full?

- Summary of the Equifax Data Breach Settlement

- The Advantages of Pre-Settlement Lawsuit Funding

- The FTC Regulates Debt Settlement Through the Telemarketing Sales Rule

- The Pros and Cons of Debt Settlement

- What Happens if I Reject a Settlement Offer?

- What Happens if You Don't Pay a Debt Settlement?

- What Happens When You Settle a Debt?

- What Is A Debt Settlement Agreement?

- What is Debt Settlement?

- What Percentage Should I Offer to Settle Debt?

- What to Ask for in a Settlement Agreement

- Who Qualifies for Debt Settlement?

- Will Collection Agencies Settle for Less?

- 5 Signs of a Debt Settlement Scam

Personal loan and debt relief reviews

We give a factual review of the following debt consolidation, debt settlement, and loan organizations and companies to help you make an informed decision before you take on a debt.

- Accredited Debt Relief Debt Settlement Reviews

- Advance America Loan Review

- ACE Cash Express Personal Loan Review

- BMG Money Loan Review

- BMO Harris Bank Review: Pros and Cons

- Brite Solutions Debt Settlement Reviews

- Caliber Home Loans Mortgage Review

- Cambridge Debt Consolidation Review

- Campus Debt Solutions Review

- CashNetUSA Review

- Century Debt Settlement Reviews

- ClearPoint Debt Management Review

- Click N Loan Reviews

- CuraDebt Debt Settlement Review

- CuraDebt Reviews: Debt Relief Assistance For California Residents

- Debt Eraser Review

- Debtconsolidation.com Debt Settlement Reviews

- Eagle One Debt Settlement Reviews

- Freedom Debt Relief Debt Settlement Reviews

- Global Holdings Debt Settlement Reviews

- Golden 1 Credit Union Personal Loan Review

- Honda Financial Services Review

- iLending Reviews

- Infinite Law Group Debt Settlement Reviews

- JG Wentworth Debt Settlement Reviews

- LoanMart Reviews

- Mastriani Law Firm Review

- Milestone ® Mastercard ® Review

- ModoLoan Review

- Money Management International Reviews

- M&T Mortgage Company Review

- National Debt Relief Debt Settlement Reviews

- New Era Debt Settlement Reviews

- OppLoans Review

- Pacific Debt Relief Reviews

- Palisade Legal Group Debt Settlement Reviews

- PCG Debt Consolidation Review

- PenFed Auto Loan Review

- Priority Plus Financial Reviews

- Roseland Associates Debt Consolidation Review

- SDCCU Debt Consolidation Review

- Speedy Cash Loans Review

- Symple Lending Reviews

- Tripoint Lending Reviews

- TurboDebt Debt Settlement Reviews

- Turnbull Law Group Debt Settlement Reviews

- United Debt Settlement Reviews

- Upgrade Auto Loans Reviews

How to repair and improve your credit score

Debt has a big impact on your credit. Below is a list of guides on how to repair and improve your credit, even while managing major debt.

- 3 Ways to Repair Your Credit with Debt Collections

- 5 Pros and Cons of Credit Cards & How to Use Them Wisely

- 6 Reasons Your Credit Score Isn't Going Up

- Bankruptcy vs Debt Settlement: Which is Better for Your Credit Score?

- Does Debt Consolidation Hurt Your Credit Score?

- Does Wage Garnishment Affect Credit?

- Guide to Disclosing Income on Your Credit Card Application

- How Long Does It Take to Improve My Credit Score After Debt Settlement?

- How Often Does Merrick Bank Increase Your Credit Limit?

- How to fix your credit to buy a house

- How to Handle Debt and Improve Credit

- How to Raise My Credit Score 40 Points Fast

- If I Settle with a Collection Agency, Will It Hurt My Credit?

- Is 600 a Good Credit Score?

- Obama Credit Card Debt Relief Program – How to Use It

- Sample credit report dispute letter

- Should I Use Credit Journey?

- Understanding myFICO: Your Gateway to Better Credit

- What Does "DLA" Mean on a Credit Report?

- What Is A Good Credit Score For Businesses?

- What is American Credit Acceptance?

- What is CBNA on my credit report?

- What is CreditFresh?

- Who Made the Credit Score?

- Why is THD/CBNA on my credit report?

How to resolve student loan debt

Struggling with student debt? SoloSuit’s got you covered. Below are resources on handling student loan debt.

- Budgeting Strategies for Students: How to Manage Your Finances Wisely

- Can You Go to Jail for Not Paying Student Loans?

- Can You Settle Student Loan Debt?

- Do Student Loans Go Away After 7 Years? (2022 Guide)

- Do You Need a Student Loan Lawyer? (Complete Guide)

- Does Student Debt Die With You?

- How to Manage a Student Debt

- How to Get Rid of Student Loan Debt

- Mandatory Forbearance Request Student Loan Debt Burden

- Negative Economic Effects of Student Loan Debt on the US Economy

- Pros and Cons of Taking a Student Loan

- Regional Adjustment Bureau Student Loans – How to Win

- The Real Impact of Student Debt: How Our Brains Handle It

- Why It's Important to Teach Students How to Manage Debt

- 5 Alternatives to Taking a Student Loan

- 5 Tips for Students: How to Create a Realistic and Effective Budget

- 7 College Financial Planning Tips for Students

- 7 Things to Consider When Taking a Student Loan

- 7 Tips to Manage Your Student Loans

Civil law legal definitions

You can represent yourself in court. Save yourself the time and cost of finding an attorney, and use the following resources to understand legal definitions better and how they may apply to your case.

- Accleration Clause — Definition

- Adjuster - Defined

- Adverse Action — Definition

- Affidavit — A Definition

- Annulment vs. divorce – what's the difference?

- Anticipatory Repudiation — Definition

- Bench Trial — Defined

- Certificate of Debt: A Definition

- Commuted Sentence – Definition

- Constructive Eviction - Defined

- Constructive Discharge - Definition

- Constructive Eviction - Defined

- Defendant - Definition and Everything You Need to Know

- Demurred – Definition

- Dischargeable - Definition

- Disclosures — Definition

- False Imprisonment Defined

- Good Faith Exception – Definition

- Hearsay — A Definition

- HOEPA – Definition

- Implied Contract – Definition

- Injunctive Relief — A Definition

- Intestate–Defined

- Irrevocable Agreement — Defined

- Joint Custody–Defined

- Litigator — A Definition

- Mediation - Definition

- Medical Malpractice — Definition

- Mistrial — A Definition

- Mitigating Circumstances — Definition

- Motion for Summary Judgment — Definition

- Nolle Prosequi – Definition

- Nunc Pro Tunc — A Definition

- Plaintiff - Definition and Everything You Need to Know

- Pro Se - Defined

- Probable Cause Hearing — Definition

- Restitution – Definition

- Sole Custody-Defined

- Statute of Limitations—Definition and Everything You Need to Know

- Summons—Definition

- Tenancy in Common – Defined

- Time Is of the Essence – Definition

- What Is the Bankruptcy Definition of Consumer Debt?

- Wrongful Termination–Defined

Get answers to these FAQs on debt collection

- Am I Responsible for My Husband's Debts If We Divorce?

- Am I Responsible for My Parent's Debt if I Have Power of Attorney?

- Can a Collection Agency Add Fees on the Debt?

- Can a Collection Agency Charge Interest on a Debt?

- Can a Credit Card Company Sue Me?

- Can a Debt Collector Freeze Your Bank Account?

- Can a Debt Collector Leave a Voicemail?

- Can a Debt Collector Take My Car in California?

- Can a Judgment Creditor Take my Car?

- Can a Process Server Leave a Summons Taped to My Door?

- Can an Eviction Be Reversed?

- Can Credit Card Companies Garnish Your Wages?

- Can Credit Cards Garnish Wages?

- Can Debt Collectors Call From Local Numbers?

- Can Debt Collectors Call You at Work in Texas?

- Can Debt Collectors Call Your Family?

- Can Debt Collectors Leave Voicemails?

- Can I Pay a Debt Before the Court Date?

- Can I Rent an Apartment if I Have Debt in Collection?

- Can I Sue the President for Emotional Distress?

- Can the SCRA Stop a Default Judgment?

- Can the Statute of Limitations be Extended?

- Can You Appeal a Default Judgement?

- Can You Get Unemployment if You Quit?

- Can You Go to Jail for a Payday Loan?

- Can You Go to Jail for Credit Card Debt?

- Can You Negotiate with Westlake Financial?

- Can You Record a Call with a Debt Collector in Your State?

- Can You Serve Someone with a Collections Lawsuit at Their Work?

- Can You Sue Someone Who Has Filed Chapter 7 Bankruptcy?

- Capital One is Suing Me – How Can I Win?

- Debt Snowball vs. Debt Avalanche: Which One Is Apt for You?

- Do 609 Letters Really Work?

- Do Debt Collectors Ever Give Up?

- Do I Have Too Much Debt to Divorce My Spouse?

- Do I Need a Debt Collection Defense Attorney?

- Do I Need a Debt Negotiator?

- Do I Need a Legal Coach?

- Do I Need a Payday Loans Lawyer?

- Does a Living Trust Protect Your Assets from Lawsuits?

- Does Chase Sue for Credit Card Debt?

- Does Debt Consolidation Have Risks?

- Does Midland Funding Show Up to Court?

- How Can I Get Financial Assistance in PA?

- How do Debt Relief Scams Work?

- How Do I Find Out If I Have Any Judgments Against Me?

- How Do I Get Rid of a Judgment Lien on My Property?

- How Do I Register on the Do Not Call List?

- How Does a Flex Loan Work?

- How Does Debt Affect Your Ability to Buy a Home?

- How Does Debt Assignment Work?

- How Does Finwise Bank Work?

- How does Navy Credit debt forgiveness work?

- How Does Payments.tsico Work?

- How Important is it to Protect your Assets from Unexpected Events?

- How is Debt Divided in Divorce?

- How Long Do Creditors Have to Collect a Debt from an Estate?

- How long do debt collectors take to respond to debt validation letters?

- How Long Does a Judgement Last?

- How Long Does a Judgment Last?

- How Long Does a Levy Stay on a Bank Account?

- How Long Does an Eviction Stay on Your Record?

- How Many Calls from a Debt Collector is Considered Harassment?

- How Many Times Can a Judgment Be Renewed in North Carolina?

- How Many Times Can a Judgment be Renewed in Oklahoma?

- How Much Do Collection Agencies Pay for Debt?

- How Much Do You Have to Be in Debt to File Chapter 7?

- How Much Does College Actually Cost?

- How Often Do Credit Card Companies Sue for Non-Payment?

- How Should You Respond to the Theft of Your Identity?

- I am being sued because my identity was stolen - What do I do?

- If a Car is Repossessed Do I Still Owe the Debt?

- Is Debt Forgiveness Taxable?

- Is Freedom Debt Relief a Scam?

- Is it Legal for Debt Collectors to Call Family Members?

- Is it Smart to Consolidate Debt?

- Is LVNV Funding a Legitimate Company? - Them in Court

- Is My Case in the Right Venue?

- Is Portfolio Recovery Associates Legit? — How to Win

- Is Severance Pay Taxable?

- Is SoloSuit Worth It?

- Is Someone with Power of Attorney Responsible for Debt After Death?

- Is the NTB Credit Card Safe?

- Is There a Judgment Against Me Without my Knowledge?

- Is transworld systems legitimate? — How to win in court

- Liquidate–What Does it Mean?

- Litigation Finance: Is it a Good Investment?

- Received a 3-Day Eviction Notice? Here's What To Do

- Should I File Bankruptcy Before or After a Judgment?

- Should I Hire a Civil Litigation Attorney?

- Should I Hire a Civil Rights Lawyer?

- Should I Hire a Litigation Attorney?

- Should I Marry Someone With Debt?

- Should I Pay Off an Old Apartment Debt?

- Should I Send a Demand Letter Before a Lawsuit?

- Should I Use My IRA to Pay Off Credit Card Debt?

- Should You Communicate with a Debt Collector in Writing or by Telephone?

- Should You Invest in Stocks While In Debt?

- Subsidized vs. Unsubsidized Loans: Which is Better?

- The Truth: Should You Never Pay a Debt Collection Agency?

- What are the biggest debt collector companies in the US?

- What are the different types of debt?

- What Bank Is Behind Best Buy's Credit Card?

- What Bank Issues Kohl's Credit Card?

- What Bank Owns Old Navy Credit Card?

- What Credit Bureau does Aqua Finance Use?

- What Credit Bureau Does Truliant Use?

- What Does “Apple Pay Transaction Under Review” Mean?

- What Does a Debt Collector Have to Prove in Court?

- What Does BAC Stand For?

- What does HAFA stand for?

- What Does Payment Deferred Mean?

- What Does Reaffirmation of Debt Mean?

- What Happens After a Motion for Default Is Filed?

- What Happens at a Motion for Summary Judgment Hearing?

- What Happens If a Defendant Does Not Pay a Judgment?

- What Happens If a Process Server Can't Serve You?

- What Happens if a Tenant Wins an Eviction Lawsuit?

- What Happens If Someone Sues You and You Have No Money?

- What Happens If You Avoid Getting Served Court Papers?

- What Happens If You Don’t Pay Speedy Cash?

- What Happens If You Ignore a Debt Collector?

- What Happens If You Never Answer Debt Collectors?

- What Happens When a Debt Is Sold to a Collection Agency

- What Happens When a Debt Is Sold to a Collection Agency?

- What If a Summons Was Served to the Wrong Person?

- What If an Order for Default Was Entered?

- What if I default on an Avant payment?

- What If the Wrong Defendant Is Named in a Lawsuit?

- What Is a Case Number?

- What is a Certificate of Judgment in Ohio?

- What Is a Certificate of Service?

- What Is a Civil Chapter 61 Warrant?

- What is a Civil Litigation Lawyer?

- What Is a Consent Judgment?

- What Is a CPN Number?

- What Is a Debt Brokerage?

- What Is a Debt-to-Sales Ratio?

- What Is a Defamation Lawsuit?

- What is a default judgment?— What do I do?

- What Is a Libel Lawsuit?

- What is a Lien on a House?

- What is a Lien Release on a Car?

- What is a Lien?

- What Is a Motion to Strike?

- What Is a Motion to Suppress?

- What Is a Non-Dischargeable Debt in Tennessee?

- What Is a Nonsuit Without Prejudice?

- What Is a Preliminary Hearing?

- What Is a Reaffirmation Agreement?

- What Is a Request for Dismissal?

- What Is a Rule 3.740 Collections Defense in California?

- What Is a Slander Lawsuit?

- What is a Stipulated Judgment?

- What Is a Warrant in Debt?

- What is ABC Financial Club Charge?

- What is ACS Ed Services?

- What is Advanced Call Center Technologies?

- What is Alimony?

- What Is Allied Interstate's Phone Number?

- What is an Affirmative Defense?

- What Is an Assignment of Debt?

- What Is an Attorney Malpractice Lawsuit?

- What Is an Unlawful Detainer Lawsuit?

- What is Bank of America CashPro?

- What is Bitty Advance?

- What Is Celtic Bank?

- What is Consumer Portfolio Services?

- What Is Credence Resource Management?

- What Is Debt Internment?

- What Is Discover's 60/60 plan?

- What is Evading the Police?

- What Is Extinguishment of Debt?

- What is First Investors Financial Services?

- What is Global Lending Services?

- What is homicide?

- What Is Lexington Law Firm?

- What is LGFCU Personal Loan?

- What is Moral Turpitude?

- What is Online Information Services?

- What is Oportun?

- What Is Service of Process in Texas?

- What is sewer service?

- What Is Summary Judgment?

- What is Synchrony Bank's Hardship Program?

- What Is T-Mobile's Phone Number for Debt Collection?

- What Is the Amount of Money You Still Owe to Their Credit Card Company Called?

- What is the Deadline for a Defendant's Answer to Avoid a Default Judgment?

- What Is the Formula for Calculating Closing Costs?

- What Is the Minimum Amount That a Collection Agency Will Sue For?

- What Is the Phone Number for IQ Data?

- What is the Purpose of the Truth in the Lending Act?

- What is the status of my case?

- What Is the Statute of Limitations on Debt in Washington?

- What is the Telemarketing Sales Rule?

- What is Unsecured Credit Card Debt?

- What is WCTCB?

- What is WFDS?

- What is WUVISAAFT?

- What is Zombie Debt, and How Do I Deal With It?

- What Personal Property Can Be Seized in a Judgment?

- What Should I Do If Crown Asset Management Suing Me?

- What Should I Do If OneMain Financial Is Taking Me to Court?

- What Should You Do if You Can't Pay Your Mortgage?

- What states require a professional licensing number for debt collectors?

- What Happens When a Debt Is Sold to a Collection Agency

- When Does Exeter Finance Repo Cars?

- When Is My Rent Due Legally?

- Where’s My Amended Tax Return?

- Which Bank Does Macy's Credit Card Use?

- Who is EOSCCA?

- Who is Over the Loan Forgiveness Program at KHESLC?

- Who is Synchrony Bank? — Beat Them in Court

- Who is Jefferson Capital Systems LLC — How to win in court

- Why Being Judgment Proof Is Not a Defense to a Lawsuit

- Why Can't Lawyers Give Legal Advice?

- Who is Over the Loan Forgiveness Program at KHESLC?

- Who is Synchrony Bank? — Them in Court

- Who Qualifies for Debt Settlement?

- Why Being Judgment Proof Is Not a Defense to a Lawsuit

- Why Can't Lawyers Give Legal Advice?

- Why Do Debt Collectors Block Their Phone Numbers?

- Why Do Lawyers Charge So Much?

- Why Is the Sheriff Looking for Me?

- Why Would a Sheriff Come to My House with Papers?

- Will Bankruptcy Stop a Judgment?

How-to debt guides

- How to Beat Westlake Portfolio Management

- How to Access Free Debt Relief

- How to Answer a Lawsuit for Debt Collection

- How to Appear in Court by Phone

- How to Apply For Unemployment Benefits in Florida

- How to Avoid Getting Served

- How to Beat a Bill Collector in Court

- How to Beat a Debt Collector in Court

- How to Beat a Lawsuit From a Debt Collector

- How to Cancel a Merrick Bank Credit Card

- How to Cancel an American Eagle Credit Card: A Step-by-Step Guide

- How to Cancel JCPenney Credit Card

- How to Deal with Debt Collectors

- How to decide what to do next in a lawsuit

- How to Defend Yourself in Court

- How To Develop A Debt Repayment Plan That Works

- How to Discharge a Debt with UCC

- How to Dispute a Debt and Win

- How to Dispute a False Positive Drug Test

- How to dispute a rental collection

- How to Drag Out an Eviction

- How to Fight a Motion for Relief From Automatic Stay

- How to Fight an Eviction

- How to Fight Debt Collectors in Court and Win

- How to File a Civil Answer in Kings County Supreme Court

- How to File a Civil Answer With the Duval Clerk of Courts - Florida

- How to File a Motion to Extend Time

- How to File a Motion to Satisfy Judgment in Utah

- How to File a Motion to Set Aside Judgment

- How to File Chapter 13 Without an Attorney

- How to File in Bergen County Superior Court

- How to File in Deschutes County Circuit Court

- How to File in Josephine County Courthouse

- How to File in Miamisburg Municipal Court

- How to File in Monmouth County Courthouse

- How to File in Oak Grove Courthouse

- How to File in Oregon Small Claims Court

- How to File in Small Claims Court in Iowa

- How to File in the Houston County Superior Court

- How To Fill Out the PLD-C-001

- How to Find My Bridgecrest Login

- How to Find Out If You're Being Sued

- How to Find Out What Collection Agency Owns Your Debt

- How to Find the Attorney That is Suing You (Secret)

- How to get a case dismissed without prejudice on statute of limitations

- How to Get a Divorce in Florida

- How to Get Credit Card Debt Relief

- How to Get Debt Relief (Ultimate 50 State Guide 2023)

- How to Get Out of a Bridgecrest Loan

- How to get out of a RISE loan

- How to Get Out of Debt Before Retirement

- How to Get Out of Paying HOA Dues

- How to Get Relief From a Gambling Debt

- How to Hire a Mediator

- How to Identify Age Discrimination in the Employment Act

- How to identify fake and abusive debt collectors

- How to Liquidate Credit Cards Into Cash

- How to liquidate your assets to pay off debt

- How to Make a 609 Letter That Really Works

- How to Make a Debt Validation Letter - The Ultimate Guide (2023)

- How to Make a Motion to Dismiss

- How to Make a Motion to Lift Stay

- How to Make a Motion to Vacate Judgment

- How to Make a Will

- How to Make an Eviction Appeal

- How to Make Motion to Set Aside — Ultimate Guide

- How to Negotiate a Lien on a House

- How to Negotiate Credit Card Debts

- How to Paramount Recovery

- How To Pay for College and Avoid Debt

- How to Pay off Your Destiny Credit Card

- How to Perform Voluntary Repossession

- How to Protect Your LLC with a Registered Agent Service

- How to Recover from a Negative Bank Balance

- How to Report the Cancellation of a Debt on a 1040

- How to Respond to a Debt Collection Summons in Wyoming

- How to Respond to a Debt Lawsuit vs United Collection Bureau

- How to Respond to a Lawsuit Against Northstar Location Services

- How to Respond to a Sheriff's Note On Your Door

- How to respond to a Summons from VanSlam, Inc

- How to Respond to Plaintiff's Counsel

- How To Respond to Request for Admission

- How to Satisfy a Judgment

- How to Spot Common IRS Scams

- How to Stop Eviction Lawyers

- How to Stop Pinnacle Collections Agency

- How to Support Employees With Debt – HR Solution

- How to Use a Bonus to Solve Your Financial Problems

- How to Travel Without Falling into Debt: Embracing the "Workcation"

- How to Use King County Superior Court Electronic Filing

- How to Use Montgomery County E-Filing

- How to use My.Loanbuilder

- How to Use the Doctrine of Unclean Hands

- How to Walk Away from Credit Card Debt

- How to Win a Citibank Debt Lawsuit

- How to Win a Collect Pros Dispute

- How to Win a Credit One Bank Lawsuit

- How to Win a Debt Lawsuit Against Security Credit Services

- How to Win a Freedom Debt Relief Lawsuit

- How To Win a Mariner Finance Lawsuit

- How to Win a Portfolio Recovery Associates Debt Lawsuit

- How to Win When Sued by Blitt & Gaines

- How to Win When Sued by Pharia LLC

- How to Win When You're Sued by Paragon Revenue Group

- How to Write a Hardship Letter

- How to Write a Re-Aging Debt Letter

Learn more with these additional debt resources

- A Comprehensive Guide to Business Loans in the U.S.

- Bar Associations for All 50 States

- Bank of America Is Suing Me For Credit Card Debt — How to win

- Best Debt Consolidation Strategies

- Biggest Debt Collection Agencies (2023)

- Budgeting for Language Learning: Tips for Language Enthusiasts in Debt

- BYU Personal Finance Online Course (How to Get Back on Track After a Debt Lawsuit)

- Collection Agencies Phone Numbers

- Cómo resolver una deuda

- Cómo responder a una demanda civil por deuda

- Countersuing a Company: A Step-By-Step Guide

- Credit Card Debt Forgiveness Act Explained

- Credit Card Debt Forgiveness Because of Disability

- Credit Repair Scam

- Debt Collection Ageny List (2022)

- Debt Collection Attorneys Near Me

- Debt Collection Litigation Industry Report 2023

- Debt Relief Programs 2023

- Debt Validation Letter Template

- Debt-Free Strategies: Leveraging Cash Value Life Insurance to Achieve Financial Freedom

- Defending Yourself in Court Against a Debt Collector

- Difference Between a Trial and a Hearing

- Do This If You're Sued by Express Recovery for Debt

- Don't Make a Payment to Arnold Scott Harris

- Everything You Need to Know About Getting Divorced

- Forging a Path to Debt-Free College: Innovative Approaches to Financing Your Higher Education

- Free Legal Aid in Bullhead City, Arizona

- Free Legal Aid in Marion, Ohio

- Fruit of the Poisonous Tree

- Going to Court for Credit Card Debt - Everything You Need to Know

- Going to Court for Credit Card Debt — Key Tips

- Guide to Elderly Debt Collection Laws

- Hearing Vs. Trial

- Help! A Debt Collector Is Calling My Work

- Help! I'm Being Sued by My Debt Collector

- Here Is Ocwen's Mailing Address

- Here's the Phone Number for Colinfobur (a Debt Collector)

- Hours of Service Violations - 10 Effects

- How a CPA Can Save Your Small Business Money

- How Attorney Contingency Fees Work

- How Credit Counseling and Financial Education Can Help You Manage Debt

- How Debt Affects Mental Health

- How Do You Demonstrate Financial Hardship?

- How Eviction Works for Renters

- How I Won My Credit Card Debt Lawsuit (Interview)

- How Legal Billing Software Streamlines Trust Fund Management

- How Not to Pay a Judgment

- How the Consumer Financial Protection Bureau Debt Collection Rule Applies to You

- How VPNs Protect Your Financial Privacy and Assist in Debt Relief

- I Got Sued Because of Credit Card Fraud—How I Beat American Express in Court

- I'm in Debt With No Job and No Money — What to Do

- Importance of Identity Verification for Buy Now Pay Later Providers

- Interview With A Former Debt Collector

- Is Zombie Debt Still a Problem in 2019

- Kentucky Debt Collection Laws — What You Need to Know

- Lawsuit Deadline Calculator (The best one!)

- Legal Aid in All 50 States

- Legal Aid in the US Ultimate Guide (2022)

- Legal Support Services for Debt Collection

- Liquidated Debt vs. Unliquidated Debt

- Living Trust vs. Will—Which One You Need

- Luxury on a Budget: 10 Ways to Have Luxury Experiences While Managing Debt

- Make Solomon and Solomon PC validate a debt

- Make Stephen Einstein validate a debt

- Massachusetts Debt Collection Laws – What They Say

- Money Management Tips for Senior Citizens

- Motion for Default Judgment - Everything You Need to Know

- My Bank Account is Negative $1,000 — Fix it

- National Debt Relief Screwed Me — What to Do Next

- Navigating Your Finances Wisely: A Look at the Best Credit Cards of 2023

- New Debt Collection Laws 2022

- Nonsuit vs Dismissal in a Debt Collection Lawsuit

- Oregon Eviction Laws - What They Say

- Overcoming College Debt Challenges: Top Strategies for Financial Freedom

- Plaintiff vs Defendant — What's the difference

- Pro Se Meaning

- Q&A How to Resolve Your Debt Lawsuit (April 19, 2023)

- Q&A: How to Resolve Your Debt Lawsuit (July 12, 2023)

- Q&A: How to Resolve Your Debt Lawsuit (July 26, 2023)

- Q&A: How to Resolve Your Debt Lawsuit (June 21, 2023)

- Q&A: How to Resolve Your Debt Lawsuit (June 7, 2023)

- Q&A: How to Resolve Your Debt Lawsuit (May 17, 2023)

- Q&A: How to Resolve Your Debt Lawsuit (May 24, 2023)

- Q&A: How to Resolve Your Debt Lawsuit | May 10, 2023

- Q&A: Resolve Your Debt Lawsuit (May 3, 2023)

- Read This if You're Being Evicted With Children

- Resolve Your Collection Lawsuit in 3 Steps

- Resolve Your Debt Lawsuit Q&A (March 29, 2023)

- Resolve Your Debt With A Summons Response: A Step-by-Step Guide

- Respond to A Rocket Receivables Collector

- RICO Charge

- Sample Answer to Summons for Credit Card Debt Lawsuit

- Sample Cease and Desist Letter Against Debt Collectors

- Sample Letter to Remove a Charge-Off from Your Credit Report

- Sirote and Permutt Foreclosure - How to Win

- SoloSuit FAQ

- States Where You Can Go to Jail for Debt

- Stop Paying Credit Card Debt and Stop Worrying About It

- Successful Tips on Dealing With Debt Collectors During the Pandemic

- Tax Debt Compromise Program Scam

- Template Cease and Desist Letters to Debt Collectors

- The 7 Signs You Need Debt Help

- The best strategies for paying off credit card debt

- The Eviction Moratorium by State

- The Eviction Moratorium in Indiana Explained

- The Future of Legal Document Automation: Trends and Predictions

- The Impact of Debt on Your Psychological Well-being

- The Legal and Compliance Aspects of GPS Tracking: Key Considerations for Employers

- The Legal Process for Burn Injury Claims: What to Expect In California

- The Pros and Cons of Chapter 13 Bankruptcy

- The Pros and Cons of Using Real Estate to Generate Passive Income

- The Ultimate Guide to Responding to a Debt Collection Lawsuit in Utah (2023)

- Tips for Leaving the Country With Unpaid Credit Card Debt

- Top 7 Debt Collector Scare Tactics

- Top Side Hustles to Pay Off Debt

- Trespassing

- USC 15 Section 1662(b) Explained

- Use MacBook and Tech to Protect Yourself From Debt Collectors Online

- Use This 11 Word Phrase to Stop Debt Collectors

- Use this Sample Answer to Summons for Credit Card Debt

- Vermont Statute of Limitations on Debt

- West Virginia Statute of Limitations on Debt

- What Are the Phone Numbers for United Recovery Systems

- What Happens After I File an Answer to My Debt Lawsuit?

- What Is Consumer Debt?

- What to Consider Before Signing a Stipulated Judgment, The Ultimate Guide

- What to Do About a Disputed Debt

- What to Do After Filing an Answer in a Debt Collection Lawsuit

- What to Do If a Debt Collector Is Attempting to Collect a Discharged Debt

- What to Do If a Debt Collector Sues You

- What to Do if You're Delinquent on Debt

- What to do when you get a fake court summons or phone call

- What to Say When You're in Court for Eviction

- What You Need to Know about ChexSystems

- Who is Jefferson Capital Systems LLC — How to win in court

- Why Being Judgment Proof Is Not a Defense to a Lawsuit

- Win Your Debt Lawsuit Q&A (April 5, 2023)

- You're Drowning in Debt — Here's How to Swim

- 3 Crazy Credit Card Debt Stories

- 3 Reasons Banks Can Freeze Your Account

- 3 Things to Know About Bright Lending

- 4 Ways to Get Local IRS Tax Help in Your State

- 5 Best Debt Reduction Services of 2022

- 5 Expenses You Can Cut to Save Money and Pay Off Debt

- 5 Legal and Deadly Lessons From Bicycle Accidents

- 5 Tips on How to Use Debt to Build Wealth

- 5 Ways Identity Theft Can Happen

- 7 Quick Solutions to Typical Family Money Problems

- 7 Ways to Protect Your Banking Information

It only takes 15 minutes.

And 50% of our customers' cases have been dismissed in the past.

"Finding yourself on the wrong side of the law unexpectedly is kinda scary. I started researching on YouTube and found SoloSuit's channel. The videos were so helpful, easy to understand and encouraging. When I reached out to SoloSuit they were on it. Very professional, impeccably prompt. Thanks for the service!" - Heather

Get Started